$4.9 Trillion Small Business Credit Gap: Digital Models to the Rescue

CGAP has written extensively in recent years about the rapidly expanding world of digital credit in developing economies, from understanding how it works in the initial days to exploring its risks as the space has scaled faster than the industry standards and regulatory oversight mechanisms that govern it. While there are real dangers in some of these digital credit models, the expansion in eligibility and reduction in cost that they enable can just as well be harnessed for positive change. Either way, it seems evident that these innovations are irreversibly changing the landscape in access to credit.

Thus far, much of the activity and discussion around digital credit has centered on low-value, uncollateralized consumer lending. Meanwhile, a potentially greater revolution in financial access has been brewing around lending to micro and small enterprises (MSEs). CGAP has undertaken a global landscaping study to estimate the opportunity size of credit to MSEs in emerging markets, outline how digital technologies are disrupting this space and describe the most promising new business models we see emerging. Below are some findings that stand out to us.

The global market opportunity for MSE credit is estimated to be $8 trillion, but more than half of it goes unmet

Lending to MSEs by traditional financial institutions in emerging markets and developing economies (EMDEs) has been extremely limited. Some of the key reasons include high cost of customer acquisition and due diligence — especially for a segment that is largely informal or semi-formal — insufficient data availability to make accurate credit assessments, uncertain customer lifetime values and high costs of distribution and servicing. Our study estimates suggest that this has resulted in a $4.9 trillion credit gap for MSEs in EMDEs, with the informal sector representing 30 percent of this unmet demand.

However, digital technologies are now enabling new business models that are better placed to respond to this opportunity and disrupt traditional MSE financing models

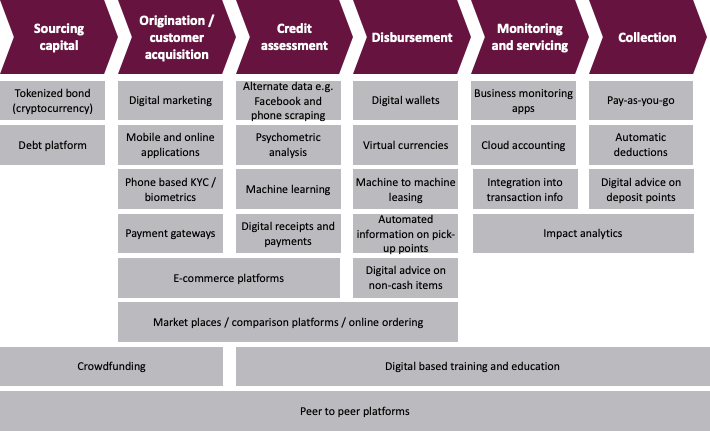

The framework below lists six key aspects of a credit value chain and identifies various digital technologies that are disrupting every aspect.

Disruptive Technologies Across the Credit Value Chain

How are emerging business model innovations potentially disrupting each link in the value chain? Let’s take a brief look.

- Capital sourcing. Deposit mobilization is the typical method of raising capital for lenders like banks and large microfinance institutions, but it requires investment in branch infrastructure that is costly and difficult to scale. On the other hand, nondeposit-taking institutions tend to raise capital from wholesale debt, which is more expensive. Moreover, financial institutions in EMDEs often struggle to source capital from wholesale markets because of their low credit ratings and country risk, limiting access and raising cost further. Typical costs of traditional deposit mobilization range from 5 to 25 percent, depending on the market.

Platform-based capital sourcing, such as peer-to-peer (P2P) lending platforms or platforms that allow a composite of financial institutions and individual lenders to fund individual or bundled loans, are emerging as strong alternatives. In P2P, the platform does not raise any capital because its role is limited to connecting individual investors to borrowers and possibly assessing borrower risk and channeling the flow of money. Participating in such platforms does now lower the cost of deposit mobilization for traditional lenders; however, there is a decrease in the cost of loan origination, risk assessment and disbursement, bringing in gains that are then passed on to the borrower.

- Origination. Finding new customers and selling them financial products also traditionally relies on expensive branches and large field forces of loan officers. But digital technologies are now allowing for new models of origination that, according to some fintechs, can reduce customer origination cost by a factor of 10 while increasing the average quality of customers recruited. This directly impacts customer retention and profitability.

Digital channels are allowing for three types of customer origination. The first is direct origination via digital channels using software, applications and/or platforms. Examples include Kabbage, BitBond and Afluenta.

The second is indirect origination via partnerships in which lenders source digital data from partner organizations. An example of this is Indifi, an Indian fintech that has partnered with over 80 organizations, including merchant acquirers and e-commerce websites. Tienda Pago in Peru, which partners with fast moving consumer goods companies for customer and loan origination, is another example.

The third way digital channels enable providers to reach customers is direct origination via in-field staff or digital marketing. Some providers use digital tools to augment traditional methods, enabling sales teams to meet customers in their areas of operation and collect know-your-customer or business data via tablets that upload information to centralized systems, allowing for quick or instant credit decisioning. One example is African lender 4G Capital.

- Credit assessment. Digital tools are allowing businesses to move away from paper and from lending based on relationships between credit officers and borrowers. Some models use direct payment integrations to gain visibility into MSEs’ digital sales (e.g., Kopo Kopo). This gives them additional capabilities, such as deducting payments at the source by taking a small percentage of all sales (which also helps MSEs by automatically keeping repayments in line with revenues). Other models directly integrate into the MSE’s backend to accurately assess inventory turnover (e.g., Sokowatch). Some providers obtain MSE data indirectly by accessing information captured by other organizations, while still others rely on proxy indicators like social media and phone scraping data (e.g., Branch or Tala).

- Disbursement. Digital tools improve the speed and ease with which credit can be disbursed. Disbursement models range from cash to noncash disbursements. Cash disbursement models involve solutions where cash is accessed at a lender or partner cash-out point or where cash is electronically credited to the borrower’s bank account or digital wallet. The first model relies heavily on cash and requires cash management, while the second model requires MSEs to have a bank account or digital wallet. Noncash disbursements usually involve the provision of a merchant’s goods when inventory is low or a direct payment to the merchant’s supplier, who then delivers more inventory to the business.

- Monitoring and servicing. This includes providing MSEs with value-added digital services that solve challenges in areas like accounting, business monitoring or business analytics. These solutions can help MSEs learn how to grow while providing their lenders with real-time information on the health of their businesses and improving repayment rates.

- Collections. Financial institutions increasingly have the option to use digital tools that can improve the ease, speed and timeliness of credit collection. Tools include scheduled payments, automatic deductions and repayment via third parties. For example, institutions like PayPal offer automated deductions at the point of sale, where repayment is a percentage of the borrower’s income and there are no fixed-maturity dates set by the lender. Other institutions use receivables-based financing where MSEs sell invoices to a lender at a discount and gain access to working capital. Lidya is one such company.

In each major link of the MSE credit value chain, digital technologies are enabling new practices that can significantly reduce cost and expand access. In another blog post, we will look at a few business models that are emerging as a result of these innovations. These models are making a significant contribution to closing the MSE financing gap and have demonstrated promise to scale.

In our next post, we will look closer at four business models that seem particularly promising for closing the MSE finance gap.

Add new comment