Agent Network Expansion: What Can We Learn from Cote d’Ivoire?

For mobile money to reach scale there are many aspects providers need to take into consideration. One of them is deploying a high-quality distribution network with extensive coverage, especially in rural and remote areas where access to financial services is often limited. In Cote d’Ivoire, not only has the market boasted impressive acceleration in terms of registered customers but the number of transaction points in the distribution networks has also seen tremendous growth. Data show that between 2012 and 2013 the number of agents grew from more than 3,000 to 12,000.

In 2013, CGAP provided funding, technical assistance and knowledge sharing to one mobile money player in Côte d’Ivoire. The objectives were twofold: (1) to expand the reach of mobile money services and improve the quality of the agent network, and (2) extract lessons learned. The project spanned a period of 18 months.

Now that the project ended, what are the results?

More than 1,500 new agents were deployed during the project. Starting from a pool of about 4,000 airtime resellers and small shops, the agent selection process was designed to recruit those demonstrating the greatest potential for mobile money activity. Two categories of agents were targeted because of their proximity and their close daily interaction with the population:

- 1,456 agents, consisting of neighborhood shops;

- 72 agents, consisting of managers of cellphone booths including 31 exclusively located in rural areas.

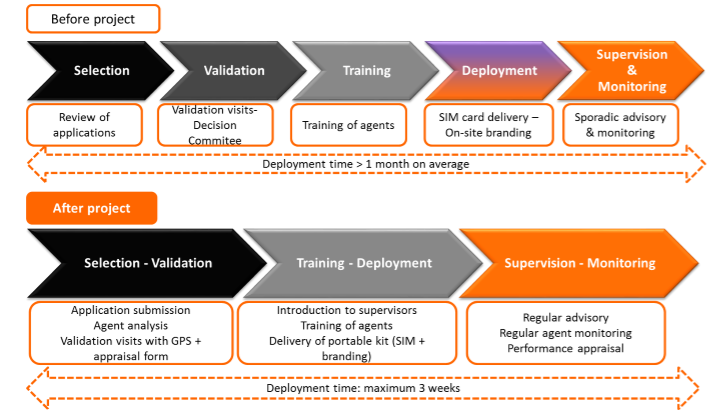

Faster deployment of agents. The mobile money provider tested and implemented adjustments to processes and arrangements. Supervisors were introduced to train and support agents with e-money management, customer experience enhancement, and fraud prevention. This helped reduce operating costs and considerably shorten deployment time (less than three weeks, instead of more than one month). Today, 45 agents a week on average can be deployed.

Agent performance improved. The mobile money provider implemented a new approach to agent selection, with the introduction of tools such as a scorecard for qualitative appraisal, GPS to optimize geographical deployment, and a system of personalized supervision and monitoring. This led to better quality in the overall agent portfolio. Newly recruited agents conducted almost 10 million transactions over a 10-month period, averaging between 400 and 600 customers a month per agent.

Personalized supervision improved agent satisfaction. Two hundred seventy neighborhood shops received personalized supervision and monitoring. On average, five agents were visited per day and per supervisor, with one or two visits per week. A survey performed on 150 agents shows high level of agent satisfaction.

Beyond these positive results, what can the project teach us when it comes to deploying mobile money agents?

Overall, it is essential that providers ensure a clear vision and buy-in across the organization to deploy agent networks at scale. A dedicated team and resources, suitable procedures, logistical support and ongoing supervision and monitoring of agents at the onset are also important factors to ensure success.

Conclusions can also be drawn from the three phases of deployment:

Selection/Validation: With the right skillsets and tools, agents will contribute to ensure the viability of the distribution network. So, the selection of agents is an essential step and if not done properly it can lead to additional costs and delays. Overall, the simple appraisal scorecard has helped the provider expedite the hiring process while optimizing the financial capacity of its agents’ portfolio and ensuring that people with an adequate profile are recruited. But two specific challenges also came up during this phase. First, some agents needed to be converted from the informal to the formal sector. This was particularly the case for cellphone booths managers who needed to obtain a business license to distribute electronic money. A partnership was established with a government agency to find suitable licensing requirements for this particular category of agents. Second, some agents need to borrow money from financial institutions to meet new working capital requirements and this requires supervision.

Training/Deployment: Agents who met their supervisors during their initial training period proved to be more efficient and results-oriented. Their performance also improved when supervisors monitored agents’ activity using simple indicators, such as level of transactions, stock of electronic value unit, etc. That said, several factors should be taken into consideration as they can delay the deployment of the agents: the paperwork needed to be able to exercise the activity of agent as well as the fact that not all applications from potential agents come completed. Moreover, human resources at the provider level must be in place to activate the SIM cards of agents to match the growth in agent deployment; if not, this can create an important bottleneck.

Monitoring/Supervision: Qualified staff is essential to supervise and motivate agents so that their performance is optimized. Supervision of agents has also helped improve the ability to deal with periodic fluctuations in deposits/withdrawals and manage the demand for units of electronic value. Finally, financial incentives for agents to open new customer accounts are an additional driver to improve performance.

The spread of agents across Cote d’Ivoire is promising but it also raises a number of questions regarding their activity level and health. We hope that providers in Cote d’Ivoire and across WAEMU can capitalize on these lessons to ensure healthy and sustainable growth of mobile money distribution networks.

Comments

Dear Omar,

Dear Omar,

Thanks for this nice blog. Developing an effective network of agents is one the biggest challenges in a Mobile Money application development; it takes a lot of time and resources. But more challenging is how to manage and maintain the network so that it grows to meet the Provider's business ambition: in that regards, monitoring and supervision is key. Thanks for sharing this experience which will certainly inspire other providers in the regions that are struggling in this area.

Great piece. Thanks.

Dear Omar, I was really

Dear Omar, I was really interested to read your last post on your blog. I discovered that your project has done a really great job to promote the accesibility and affordability of Mobile Money for Ivoirian people especially in rural areas. Your method of intervention and support seems well designed and very effecient and I'm sure that it can be productively duplicated in other West African countries where MM agent network are less consistent and well diffused. For instance in Burkina Faso, our geo-marketing study of Airtel Money network indicates that the latter is still concentrated in urban areas. Therefor its level of accessibility in peripherical areas and in rural regions is a challenge to overcome. To deeper understand your project and his concrete consequences, I will be very interested to have an email exchange with you. Congratulations for your work and thanks in advance for your answer. Simon

Dear Simon,

Dear Simon,

Thanks for your contribution. Is it possible that you share with me your geo-marketing study for Airtel-Money in Burkina.

Thanks in advance.

Christian.

Is very interesting to know

Is very interesting to know how mobile money is catching up with the people of Ivory Coast, especially the approach adopted through the able assistance from CGAP . This approach could be a learning platform for Regional uptake of digital financial services .

I believe that West Africa has the potential to develop one of the emerging economic resource for national development namely Digital financial services.

Thank you.

Add new comment