Is Funding for Rural Finance Going Where It’s Needed Most?

Today, more than 50 percent of the population in developing countries lives in rural areas, where agriculture is the largest source of household income. Financial services matter in these communities because they can help farmers increase their yields and strengthen food security, make bigger investments, manage expenses and access essential services. Addressing these populations’ financial needs continues to be an imperative for many international funders.

For two years in a row, rural and agricultural finance has been one of the most heavily funded project areas for international funders, according to CGAP’s last two funder surveys. Out of the 3,200 projects covered in the latest survey, which covers the year 2016, there were 647 projects in 97 countries whose various goals included improving access to finance in rural areas, with every funder reporting at least one project with this theme. Total commitments reached close to $5 billion.

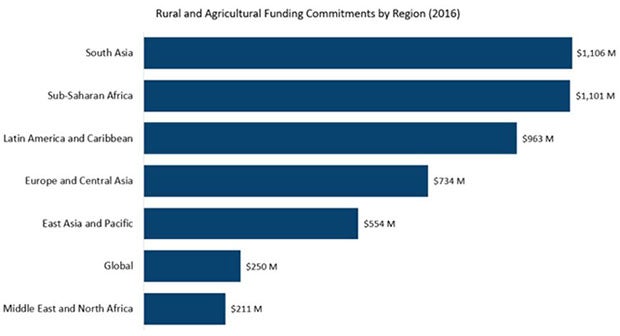

About half of the total funding to rural and agriculture finance is spread evenly between Sub-Saharan Africa and South Asia, two regions with large rural populations and economies that rely on agriculture as a source of growth. Perhaps more surprising is the amount of funding going to the Latin America and the Caribbean (LAC) and Eastern Europe and Central Asia (ECA) regions, which depend less on agriculture and have smaller rural populations.

International funders predominantly focus on rural areas that have lower levels of financial inclusion. Half of rural and agriculture finance commitments go to countries in which just 25-50 percent of people in rural areas have accounts with financial institutions (accounts serving as a proxy for financial inclusion). This allocation of funds might explain the high volumes going to LAC and ECA, as both regions fall into this category. Another 31 percent of funding goes to countries where less than 25 percent of the rural population has an account.

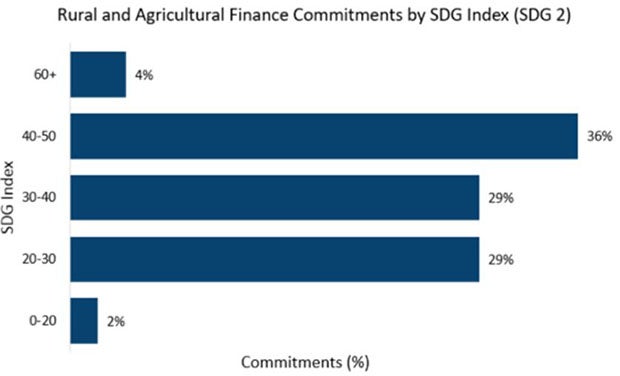

Similarly, most funding goes to countries that have not made significant progress toward achieving Sustainable Development Goal 2: “End Hunger, Achieve Food Security and Improved Nutrition, and Promote Sustainable Agriculture,” as measured by the SDG Index. The index evaluates countries' progress on a scale of 0 (worst) to 100 (best). Based on CGAP Funder Survey results, we see that 96 percent of rural and agricultural finance funding commitments focus on countries with an index below 60.

Overall, these findings tell us that funders are doing a good job of targeting the most vulnerable countries. What they don’t tell us is whether their efforts are advancing financial inclusion in rural areas, reducing rural poverty and food insecurity or achieving sustainable agriculture. Here are a few questions worth exploring:

- Are we seeing progress in rural financial inclusion? How have funders contributed to this progress?

- What are the barriers that are preventing financial inclusion in rural areas? Are funders focused on removing them?

- Are funders using funding instruments in optimal ways that contribute to the sustainable development of financial markets that serve poor, rural households?

We welcome readers to share their thoughts and experiences on how funders are advancing financial inclusion in rural areas.

Comments

Dear Estelle/Olga/Eda,

Dear Estelle/Olga/Eda,

1) Thanks for your article on Rural Finance.

2) If one put all the public disclosed document of World Bank supported project in Bangladesh at one table it will be visible like crystal that most of the funds are going for "Elite Capture" as being promoted by World Bank instead of to rural poor.

3) I am willing to arrange sustainable income generating activities for the poor and extreme poor house hold mainly women .

4) Please let me know if you can help us in any way .

Await your response.

Regards

Mahina Arefin

Add new comment