Kenya’s Rules on Mobile Money Price Transparency Are Paying Off

“Please don’t forget to include the cash out fee . . .”

Anyone who’s transferred mobile money to someone else in a country like Kenya has heard this request. It’s a noteworthy request for two reasons. First, it shows that many Kenyans are price-sensitive to small values. Second, it reveals that many of them are also aware of cash-out fees. But do Kenyans know what they’re being charged when they send money, not just when they cash out? Fortunately, since Kenya began forcing providers to disclose fees, the answer is increasingly yes.

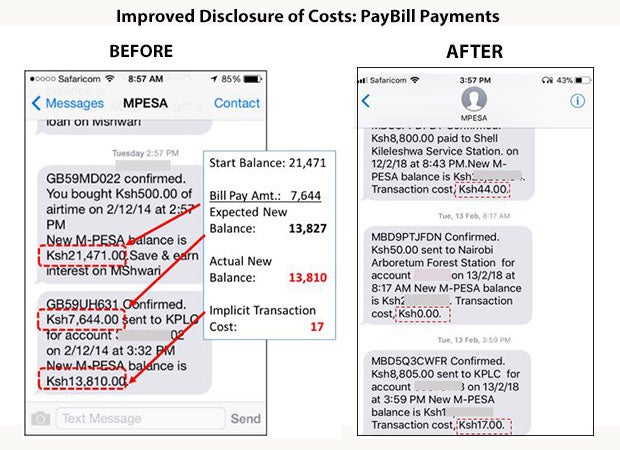

For years, Kenya’s digital financial services (DFS) providers did a poor job disclosing the costs of person-to-person transfers, bill payments and loans. To address this lack of transparency, the Competition Authority of Kenya (CAK) in 2016 required mobile financial services providers to disclose their costs via customers’ mobile handsets. Since then, disclosure has improved substantially in person-to-person payments, bill payments and digital credit.

To understand what impact (if any) this was having on consumers, CGAP surveyed 825 Kenyan DFS users in November 2016, just before providers began complying with the new policy, and again in November 2017, after most providers had complied. Our findings offer evidence that in-channel pricing transparency in DFS matters. Two of the more interesting findings relate to person-to-person transfers and digital credit.

Today’s customers are more aware of person-to-person transfer fees

For M-Pesa and Airtel Money, consumers’ pricing awareness improved from baseline to endline across several transfer amounts. The charts below show shifts in the percentage of respondents who correctly guessed how much they would have to pay to send someone Ksh 500.

The M-Pesa findings are particularly interesting. Many respondents who guessed incorrectly thought that the company’s pre-August 2014 rate of Ksh 27 was still in effect, which is significantly more than the actual Ksh 11. In effect, it appears that a lack of price transparency has been leading consumers to believe that M-Pesa transfers are more expensive than they are.

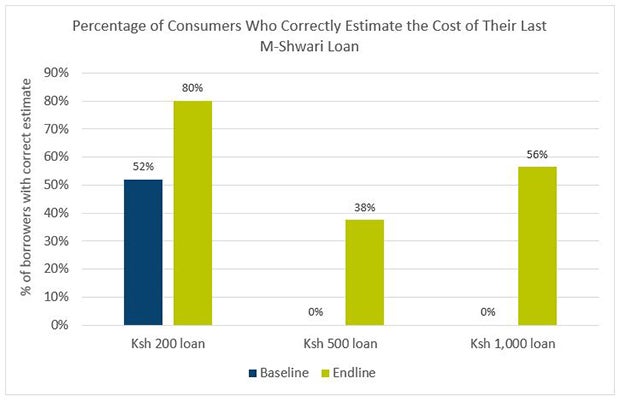

Customers are also more aware of the cost of digital credit

Digital credit has taken off in Kenya in recent years, raising opportunities for innovation and consumer protection issues, including concerns about the high prices of loans. While many app-based lenders used innovative formats to disclose prices clearly to consumers, lenders using USSD or SIM Toolkit did not always present costs in a transparent manner. This is significant because most digital credit users borrow on non-app channels. For example, 79 percent of our endline survey respondents had used digital credit products, and 64 percent of the respondents had used M-Shwari, the dominant, SIM Toolkit-driven product of M-Pesa and the Commercial Bank of Africa. The survey findings for M-Shwari show that people who had taken an M-Shwari loan of Ksh 200, Ksh 500 and Ksh 1,000 were more aware of the costs after the CAK policy.

Given the high cost of digital credit and recent concerns raised about borrowing patterns in Kenya, including indications of possible debt distress, improved transparency and price awareness is particularly important in digital credit.

Transactions not affected by CAK policy tell a different story

Withdrawal fees from mobile money and banking agents were not impacted by the CAK policy. Not surprisingly, there was not much change — and sometimes change in the wrong direction — regarding price awareness for these transactions.

This lack of impact suggests that the positive change in other transactions is at least partially due to the improvements in pricing disclosure mandated by CAK. Other factors could be at play, and for ethical reasons a randomized control trial was not an option in this study. As such, the findings cannot prove full causality, but the fact that price awareness shifted only for the transactions affected by the ruling indicates that some of the impact is likely due to the policy reform.

How long must consumers wait for transparency?

The story of pricing transparency in Kenya appears to have a happy ending. However, Kenya remains the exception in Africa, not the rule, when it comes to pricing transparency. Even in countries that have integrated transparency into their e-money regulations, it’s often unclear when and how providers are required to disclose prices, and enforcement appears to be limited in some markets.

Pricing transparency is hard to argue against, and it is relatively easy to monitor on standardized DFS channels. This makes the lack of proper enforcement in several DFS markets particularly noteworthy. If policy makers are serious about ensuring consumer protection keeps pace with product innovation, they would do well to follow Kenya’s lead by issuing basic rules and monitoring providers’ disclosure of key terms and prices on digital channels.

Comments

Thanks Rafe!

Thanks Rafe!

Hidden fees remain a big issue in the banking sector too, and a good example is in funds transfer, where neither the sender nor the receiver knows the amount of fees that were deducted or to which bank these fees were paid to.

Hi Rafe, thanks for this

Hi Rafe, thanks for this useful article. One reason why customer understanding of P2P fees improved but remains quite low for M-Pesa accounts may be the fact that as of Feb 2018, this functionality still had not been enabled for people who use M-Pesa via STK. Another reason may be that P2P cost is less important to the average client than other factors, such as convenience, safety, and speed.

Add new comment