Kenya’s Digital Credit Revolution Five Years On

Five years after Kenya launched the world’s first digital credit solution, the market for digital credit has expanded rapidly in Kenya and many low-income countries. But exactly how big is the market? Who’s using digital credit? And what impact is it having on low-income customers? FSD-Kenya, in partnership with the Central Bank of Kenya (CBK), Kenya National Bureau of Statistics (KNBS) and CGAP conducted a nationally representative phone survey with over 3,000 Kenyans to find out. The findings suggest that digital credit has become a leading source of credit in Kenya and that it is mostly used to finance working capital and day-to-day consumption needs. But it also suggests many borrowers are struggling to repay. Here are some key takeaways.

More than one in four Kenyans has taken a digital loan

Based on the survey, we estimate that 27 percent of Kenyan adults (18+) have taken at least one digital loan — for a total of over 6 million borrowers. Most have taken a loan in the past 90 days, suggesting a large number of active borrowers. Still, most Kenyans have never used digital credit. When asked why, most respondents cited an aversion to debt, with 34 percent mentioning their “fear” of taking loans. Many stated that they do not need a loan (29 percent) or lacked awareness about existing digital credit solutions (21 percent). Only 13 percent stated that they do not borrow because they do not qualify. (However, interviews with providers confirm that the percentage of customers who have a low credit score and do not qualify is higher.)

M-Shwari leads the digital credit market, but market entrants are catching up

M-Shwari seems to have benefitted from a first-mover advantage. Today, it has more than twice as many unique borrowers as its closest competitor, KCB M-Pesa. Both services are offered through Safaricom’s M-Pesa platform — Kenya’s largest telecommunication provider — and reach a network of customers that is far higher than any individual bank or FinTech can reach. Nevertheless, customers today can choose between a plethora of solutions. Kenya’s three largest banks (Kenya Commercial Bank, Equity Bank, and Co-operative Bank) have launched their own digital credit solutions since 2016, either by partnering with Safaricom (e.g., KCB), establishing an independent virtual mobile network operator (e.g., Equity’s Equitel) or developing a standalone smartphone app (e.g., Cooperative Bank’s M-Coop Cash). Many FinTechs have entered the market, too. While the chart below mentions the largest players, dozens of other solutions are available. The past two years have seen the entry of many unregulated players. Though there have not been many known cases of fraud or privacy concerns, an oversight body should be designed to monitor this growing market segment.

Kenya’s digital borrowers are more diverse today

The survey confirms earlier studies by showing that digital credit appeals to younger customers who tend to be male (55 percent), urban (55 percent) and relatively highly educated. However, the customer base for digital credit seems to be diversifying, especially from a gender perspective. Previous research estimated a 59 – 41 percent ratio of men to women unique borrowers in digital credit. This survey reduces the gap to 55 – 45 percent. However, the positive trend in unique borrowers does not mean that the gap is reducing also in terms of volumes and values of digital lending. Interviews with providers confirm that men tend to borrow more often and larger sums, on average.

Digital credit is used mostly for working capital

The most common reasons for digital borrowing among Kenyan adults are business and day-to-day needs. The use patterns do not differ much between men and women, but income sources seem to play an important role. The chart below shows that casual workers, dependents and formal employees borrow mostly for day-to-day needs. Customers who run their own company or farming operation mostly borrow for business purposes. Entrepreneurs borrowing for working capital needs is the single most common use case for digital credit.

It is difficult to determine the extent of borrowing for temptation goods or sports betting. Only 3 percent of digital borrowers reported sports betting as a reason to get a loan. However, when we asked all respondents separately if they have tried mobile betting, we saw that digital borrowers are almost twice as likely to have tried mobile gambling compared to nondigital borrowers. Obviously, there could be many reasons for this, and more research is needed to shed light on this issue.

Many digital borrowers struggle to repay on time

The rise of the digital credit market has raised concerns about the risk of excessive borrowing and over-indebtedness among lower-income households. Digital loans are easy to obtain, short-term, carry a high interest rate and are available from numerous bank and nonbank institutions. The survey found that 14 percent of digital borrowers were repaying multiple loans from more than one provider at the time of the survey. This means over 800,000 Kenyans were juggling multiple digital loans. Although having multiple loans is not necessarily an indicator of debt distress, it is important to closely monitor the market going forward and detect possible risks.

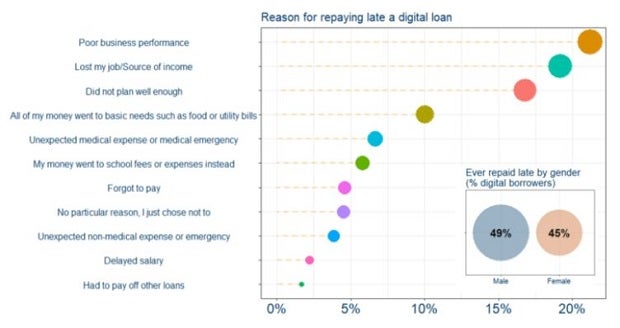

It is also important to note that debt stress does not occur only when customers borrow multiple loans: It can happen even with a single, microsize loan. About half of those surveyed reported being late at least once with their digital credit and about 13 percent admitted defaulting on their loan, although the actual number may be higher due to under-reporting. Over half of digital borrowers reported dipping into their short- and long-term savings to pay back a loan, 20 percent reported reducing food purchases and 16 percent reported borrowing (mostly through family and friends). The main reasons for late repayment are problems with business performance and losing a key source of income.

Digital credit complements other forms of lending

At the time of the survey in 2017, digital credit was the most used source of credit among phone owners at 19 percent. Yet the chart below shows that use of informal loans is similar among digital borrowers and nondigital borrowers, indicating that digital credit complements, rather than replaces, informal sources. The same goes for formal sources. In fact, digital borrowers are considerably more likely to use bank credit and SACCO loans.

Has digital credit delivered on its promise?

Over 6 million Kenyans have gained access to a technology that can deliver microloans within seconds and build a credit history that can, in theory, give them access to larger and cheaper loans in the future. While this represents a tremendous step for formal financial inclusion, more research is needed to understand the real economic and social impact of digital credit on low-income Kenyans.

The findings suggest that although many bank and nonbank institutions have entered the market, only a few reach a significant market share. Digital borrowers tend to borrow frequently, and it is therefore important to build better mechanisms to monitor consumer protection and over-indebtedness. It is also crucial to ensure that repeat digital borrowers can graduate to larger and more affordable loans as they build positive credit histories.

Despite the growth of the market, digital credit is not reaching everyone. It remains ill-suited for most of the population, such as farmers and casual workers, whose livelihoods are characterized by irregular cash flows. Reaching these segments will require deeper understanding of their financial lives, the key risks that they face and day-to-day liquidity needs.

Comments

Great article indeed. I bet

Great article indeed. I bet we have a lot to learn in Zambia.

Fascinating study and well

Fascinating study and well done CGAP. WIZZIT International have been in the financial inclusion space for 14 years and are widely regarded as pioneers in the use of mobile technology to bank the unbanked. The lessons are simple. Education is key. Telcos whilst having a massive customer base in places like Kenya need to learn from the MFIs who have been at his game for a long time. It is not difficult to lend money out. It is very difficult to collect the repayments. Getting people into debt is not helping anyone. Let’s focus on teaching people to save and to make their lives more convenient, safer and cheaper in using electronic payments gradualllyvmoving them away from cash.

Digital Credit Systems have

Digital Credit Systems have had an interesting impact on financial inclusion in Kenya as there are multiple lending platforms but an unregulated market players pose a risk. We need an oversight body to monitor this FinTech market as it seems more players may enter the market over time. Good Article.

Very informative and

Very informative and insightful

Add new comment