New Data Finds Mobile Money "On the Cusp" in Rwanda and Ghana

New data provides the most comprehensive picture yet of digital financial services (DFS) access and usage in Ghana and Rwanda. Released today, Financial Inclusion Insights surveys (FII) in both markets provide nationally representative data on DFS that facilitates comparisons with other global leaders. Several key findings emerged from the surveys.

Rwanda and Ghana are on a similar trajectory…

Similar proportions of the adult populations in Rwanda and Ghana are actively using mobile money:

- Twenty percent of adults in Ghana and 23% of adults in Rwanda now have mobile money accounts; while

- 17% of adults in both Rwanda and Ghana have their own mobile money accounts that were used in the last 90 days.

These figures position Rwanda and Ghana behind the three regional leaders, Kenya, Tanzania and Uganda, but ahead of many other countries where DFS is on the rise.

…Despite very different underlying conditions.

Ghana is in some ways the most “DFS-ready” country in Africa:

- 92% of adults have the required ID necessary to open an account;

- 95% have basic numeracy; and

- 91% own a mobile phone and 74% already send and receive text messages.

In contrast, Rwanda faces bigger challenges in DFS readiness and in some ways is punching above its weight in progress made so far:

- 87% of adults have an ID necessary to open a financial account;

- 87% of adults have basic numeracy;

- Only 47% of adults own a mobile phone and just 37% send and receive text messages.

- Rwanda is poorer than Ghana - 57% of adults said they were unable to earn more than they spend each month in comparison with Ghana’s 14%.

Despite seemingly having all the ingredients in place, DFS has not reached the same penetration in Ghana as its East African counterparts. By the same token, Rwanda’s success so far has occurred against the odds.

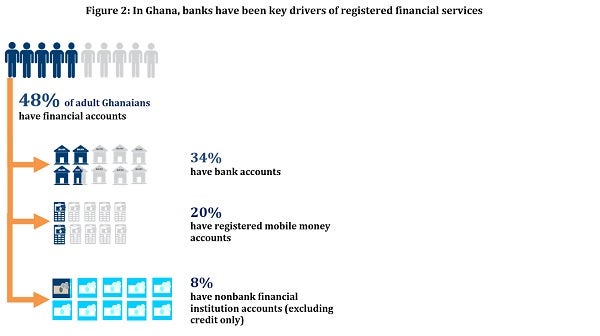

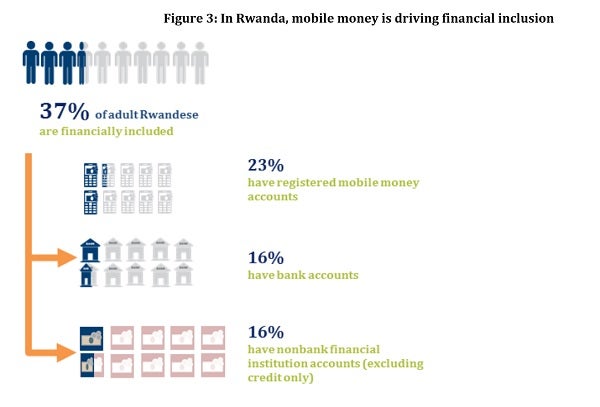

The story behind this is complex, but customer incentives are likely playing a big role in this scenario. In Rwanda, only 16% of adults already have a bank account, and mobile money is often their only option when it comes to formal financial services. In Ghana, however, 34% of adults already have a bank account, and 45% of those individuals access it through mobile apps or the internet. Since they are able to bank elsewhere, they may have less initial incentive to try mobile money.

There is cause for optimism in Ghana, however, as CGAP estimates (based on supply-side numbers from providers) that the number of active users has increased about 2.5 fold in just one year. CGAP expects this trend to continue, especially in light of the new regulations passed in July 2015 and an awakening among policymakers of the critical role that mobile money plays in driving financial inclusion.

In Rwanda, mobile money is a common source of financial inclusion

Encouragingly, mobile money is extending financial services to people in Rwanda who live on less than $2.50 per day and/or in rural areas. Of Rwanda’s active mobile money account holders, 61% live in rural areas and 72% live on less than $2.50 per day. In Ghana these numbers are tilted in the other direction – 60% of active mobile money account holders live in urban areas, and 19% live on less than $2.50 per day.

Opportunity awaits

In both countries, the current dominant use case for mobile money is to send and receive payments to other people. In fact, over 40% of active accountholders in Rwanda used mobile money for the first time to receive money from another person. However, in Rwanda an impressive 25% of active mobile money account holders used it to pay bills (primarily electricity bills). This is higher than any other African country tracked by FII: The average for Kenya, Tanzania and Uganda is 17%. This highlights the biggest opportunity for mobile financial services: digitizing existing payment streams and behaviors.

There are several examples of ways digitizing payment streams could lead to increased usage of mobile money:

- Insurance. Both Rwanda and Ghana have high rates of adults paying for insurance. Seventy-one percent of adults report paying for insurance in Rwanda compared to 59% in Ghana. However, just 0.1% of adults pay for insurance via mobile money in both countries.

- Savings. In Ghana, 67% of adults save, and in, Rwanda, 35% of adults save, but just 1% do so via mobile money in each country.

- Wages. Nineteen percent of adults in Rwanda receive wages from their employers (not counting self-employment), but only 0.3% do so via mobile money. Similarly, 27% of Ghanaian adults collect wages, but only 0.5% do this through mobile money.

Mobile money can drive financial inclusion in these countries only if a range of services is offered by providers and subsequently used by customers.

In sum…

Both markets face challenges but also demonstrate considerable opportunity for expanding access and usage of digital financial services. We hope the FII surveys give policymakers and providers new insights and ideas to overcome critical barriers and realize the potential of DFS in their markets.

Add new comment