Smallholder Households: A Financial Inclusion Imperative

CGAP launched the Smallholder Households Financial Diaries (the “Smallholder Diaries”) in June 2014, and early insights have emerged. The Smallholder Diaries track the cash flows of 270 households in Mozambique, Tanzania, and Pakistan over one year of their lives. Drawing on the initial data, a new Focus Note provides a first look at how smallholder households weave together agricultural and nonagricultural sources of income and employ a range of financial tools to meet their family needs. Here are three highlights from the Smallholder Diaries to date.

1. Smallholder households earn income from both agricultural and nonagricultural sources

Smallholder households generally earn income from a range of sources, in and outside of agriculture, including agricultural production, odd jobs, self-employment, and transfer payments. Note that the Smallholder Diaries counts each crop and type of livestock as a separate source of agricultural production income, given the distinct costs, timing, markets, and risks that may be associated with each.

Disaggregating between agricultural and nonagricultural income, early results show that Smallholder Diaries households draw on a blend of both. Households in Tanzania reported on average the fewest sources of income from agricultural production (2.8) as well as the most nonagricultural ones (8.1). In Pakistan and Mozambique, households reported relatively similar numbers of agricultural income sources (4.1 and 4.5 respectively) and nonagricultural income sources (3.9 and 3.4 respectively).

As Figure 1 illustrates quite clearly, Smallholder Diaries households earn income from raising crops and livestock, but that’s not all. There are additional income sources unrelated to agriculture. But what proportion of total household income comes from agricultural production, and how does it fluctuate over the year? We’ll tackle this important question about the relative volumes of the various income flows when data collection is complete.

2. Smallholder households use a range of financial tools

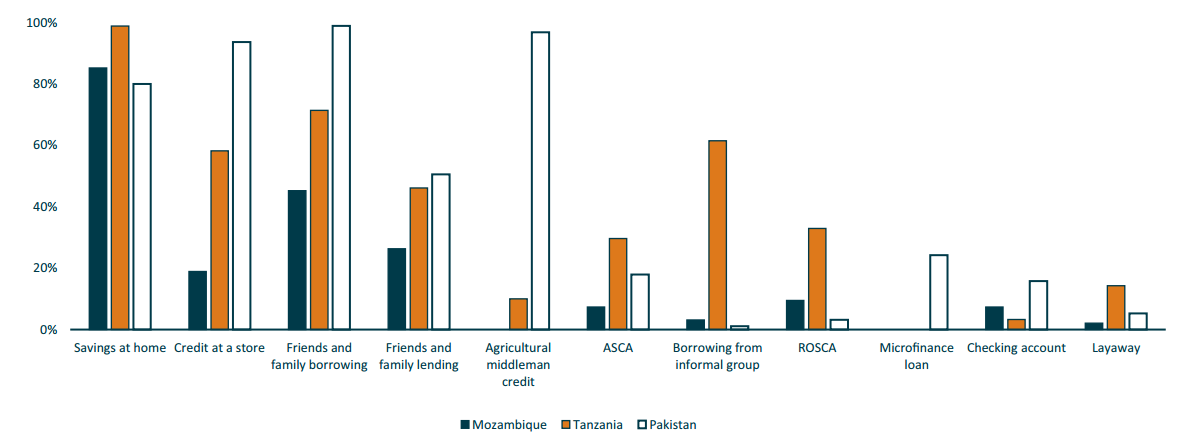

Smallholder Diaries households use a variety of financial tools, both formal and informal, to pay, store, transfer, and invest. Figure 2 shows the percentage of households in the sample that employ each particular financial tool.

Savings at home is clearly prevalent across all three countries, as are informal credit at a store and lending and borrowing from friends and family. Participation in Rotating Savings and Credit Associations (ROSCAs) and Accumulating Savings and Credit Associations (ASCAs) is most common among households in Tanzania, while in Pakistan credit from agricultural middlemen, or arthis, is nearly universal. These loans are typically repaid in cash or in-kind after that crop has been harvested, though families can also rely on arthis to finance other major expenditures, such as weddings or emergencies.

Smallholder Diaries households are active across a busy universe of financial tools, putting a variety of formal and informal relationships to work in their financial lives. Households do not rely on any one financial mechanism and in many cases use more than one of the financial tools—such as savings groups, store credit, and borrowing and lending within family and friends—for different purposes or just to maintain options. The financial portfolios of the Smallholder Diaries households are complex, but not necessarily complete. Clear opportunities to improve and innovate remain.

3. Smallholder Diaries methodology reveals both complexity and opportunity

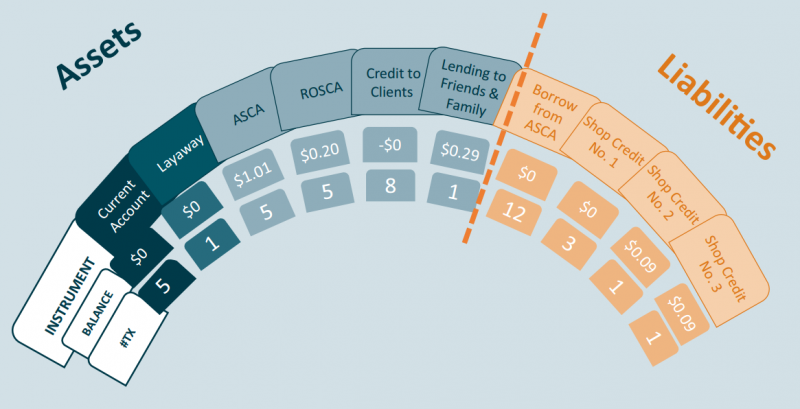

The Smallholder Diaries methodology generates extensive data over the year, collecting on average more than 2,400 data points for each family. The results produce a balance sheet for each household that details the sources and uses of income, interplay among cash flows, role of in-kind agricultural income, financial tools in use, and pain points where additional or improved financial tools could add value. Figure 3 shows the financial portfolio of Claudia and Ercilio’s household in Mozambique. It portrays the ten financial tools they used between 15 July and 30 November 2014 with assets are on the left and liabilities on the right, specifying the number of transactions and end balance of each and coloring more formal tools in a darker shade.

The current account and layaway product are Ercilio’s and the rest of their financial tools are managed by Claudia. She maintains three shopkeeper credits, using them infrequently and keeping the balances low, and manages an ASCA, which she uses to save and borrow. Claudia drew on savings and informal credit to purchase food, clothing, and petrol for their son’s motorcycle before the harvest, when cash was low and they were waiting for income from crop sales. But could a different or improved financial tool have helped the family better manage this lean period before the harvest? Could another layaway product help them purchase agricultural inputs? Or set aside money for school fees? Would using a mobile phone to manage the ASCA add value?

As the Smallholder Diaries continue to capture ebbs and flows in income and consumption, household shocks, and volumes of various income sources and financial tools, a richer picture of the financial lives of smallholder families will emerge. Opportunities will also become clearer for financial service providers, policy makers, funders, and other stakeholders to improve and innovate in the financial tools reaching Claudia and Erciliio’s family, and other smallholder households like theirs.

Add new comment