Interpreting the Financial Inclusion Numbers in Pakistan

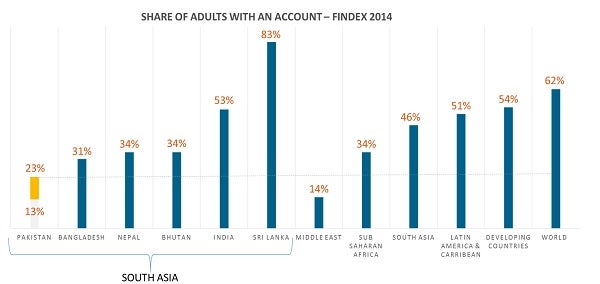

Financial inclusion in Pakistan has improved slowly but steadily since 2008 according to most sources. This observation is based upon one topline indicator - percentage of the adult population that is financially included - which is calculated by three different institutions in Pakistan. Depending on what data set you look at, the topline financial inclusion figure for Pakistan in 2014-2015 can be 7% (Financial Inclusion Insights 2014), 13% (Global Findex 2014) or 23% (Access to Finance 2015).

Such vast variances evoke two questions: 1) why do these differences exist, 2) what do they really tell us about the state of financial inclusion in the country?

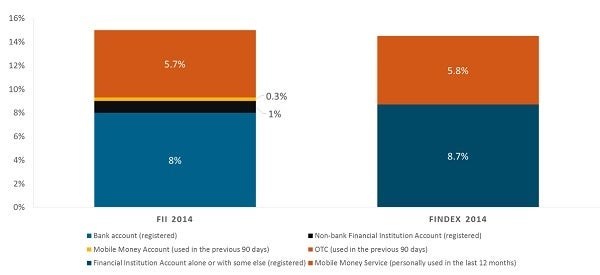

It is important to understand that despite the abundance of financial inclusion surveys conducted in Pakistan, the topline financial inclusion number is not defined in a standard way. In the case of Access to Finance, financial inclusion refers to access to formal financial services and covers households; Findex’s calculation covers individual account holders, and/or those who have used mobile money in the last 12 months; and FII’s definition is limited to individual account holders who have access to a full suite of financial services (i.e. accounts that can be used for uses beyond savings). While these different definitions cause the topline number to vary, digging in deeper to the two most comparable data sets in terms of collection, FII and Findex, reveals that the disaggregated numbers look very similar. Thus both FII and Findex predict that approximately 9% of adult Pakistanis have a registered financial institution account, and approximately 6% have actively used mobile money services.

Despite the varying definitions of financial inclusion, in all three cases the top line number looks at only one thing: number of accounts. Undoubtedly this is an important number because it provides an easy way of creating a baseline, and quantitatively measuring the general trajectory of a country over time. Additionally, this quantitative measure allows for regional and global comparisons, both of which reveal that even taking into account the highest available top line financial inclusion number (23% according to Access to Finance 2015), Pakistan lags behind significantly in the financial inclusion arena.

However, this measure of accounts only tells a part of the story. It focuses on the population that is included instead of looking at those who remain outside the formal financial sector, and answering the fundamental question of “why”. Are people financially excluded by choice? Do they lack knowledge about available services; do they lack the requisite skills needed to utilize these services; do current services fail to meet their daily needs; do closed loop systems hinder service adoption; is an external “push” required for people to join the formal financial sector? Answering these questions not only brings another dimension of richness to our understanding of financial inclusion, but in an ironic twist will also help us to understand how we can drive the topline figures upwards. In this blog series we try to answer some of these questions within the Pakistani context.

For more information, please refer to "Using Mobile Money to Promote Financial Inclusion in Pakistan," by Karandaaz Pakistan.

Comments

1. Pakistan can improve its

1. Pakistan can improve its coverage once it is able to popularise the use of accounts for the public.

2. It is suggested that the government of Pakistan may add a column in Census survey to be held soon, which may ask if a family member has a bank account. This authentic survey and its digital data can help in targeting the villages with very low accounts.

3. It is appropriate that first only households without a bank account are identified and covered with intensive campaigns. Covering adults can wait in our poorer communities.

4. It may be useful for Pakistan to study the strengths and weaknesses of Indian model of financial inclusion so as to Improve the effectiveness of its efforts

Thank you for an insightful

Thank you for an insightful analysis about multidimensional stories behind "financial inclusion" indicators. Often times people do not pay close attention on what your indicators are actually telling or we fail to explain the implications of them.We should be really careful when formulating FI indicators and interpreting statistical analysis.

Add new comment