The Promise of Mobile Money in Pakistan

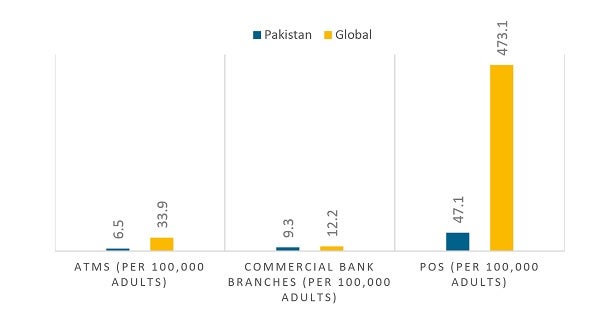

The penetration of traditional financial service delivery channels in Pakistan is low in comparison to the global average. There are approximately five ATMs and nine commercial bank branches per 100,000 adults in the country versus the global average of approximately 34 ATMs and 12 commercial bank branches per 100,000 adults (World Bank, 2013). Given the country’s goal of achieving universal financial inclusion, as articulated during the National Financial Inclusion Strategy launch in May 2015, this infrastructure gap is a hurdle that must be overcome.

Notably, 79% of adult Pakistanis aged 15 and over can access a mobile phone; while mobile ownership is relatively lower at 59% (InterMedia, 2014), this number still represents a significant proportion of the adult population. In addition Pakistan has 84 active agent outlets per 100,000 adults (IFC, 2013). These numbers indicate that cell phones, and mobile money, are perhaps the most viable channel to enable financial outreach to the average Pakistani.

Since the introduction of the Branchless Banking Regulations in 2008 by the State Bank of Pakistan, the mobile money industry has grown from a fledgling industry to a thriving one. Today there are eight live mobile money service providers based on four different business models in the market who are developing and testing new products, and serving new market segments every day. Within 5 years (2008 - 2013), the value of mobile money transactions reached 3.5% of GDP. The use of mobile money services appears to be increasing across the board, with the average number of daily transactions going up over threefold between December 2011 and December 2014, and the average value per transaction increasing by almost 35% in the same time period.

The two mobile money models

The two primary mobile money models used in Pakistan are OTC (over the counter) and mobile wallets. OTC dominates the market, representing around 88% of all customer oriented transactions volume, and 83% of all customer oriented transactions value. According to the Financial Inclusion Insights survey 2014, 19 times more adult Pakistanis actively use OTC than mobile wallets (5.7% versus 0.3%). While OTC transactions obviously provide a value proposition to providers in the form of huge transaction numbers, and customers in the form of a cheap and convenient payment channel, when it comes to driving financial inclusion mobile wallets are the real game changer. Thus while the OTC model should be kept alive, ideally it should be used as a way of introducing people to and making them comfortable with the concept of mobile wallets.

New branchless banking regulations this past year have made it increasingly easy to open and operate a mobile wallet account. The recent national SIM reverification drive (Jan-April 2015) has ensured that every phone number is now linked to a biometrically verified National Identity Card Number; this rich data fulfills the KYC requirements for opening level 0 accounts and allows for remote account opening. In Pakistan, level 0 accounts are one of the three tiers of customer mobile wallet accounts: level 0, level 1 and level 2. Each level has progressively higher account and balance limits, and thus progressively more stringent KYC requirements.

The State Bank of Pakistan has allowed a few providers including Easypaisa, UBL Omni and Mobicash, to remotely open level 0 mobile wallet accounts. This means that customers can now open a mobile wallet by texting a simple SMS string. This ease of opening is complemented by higher account limits for level 0 accounts for some providers, and significantly reduced verification costs across the board.

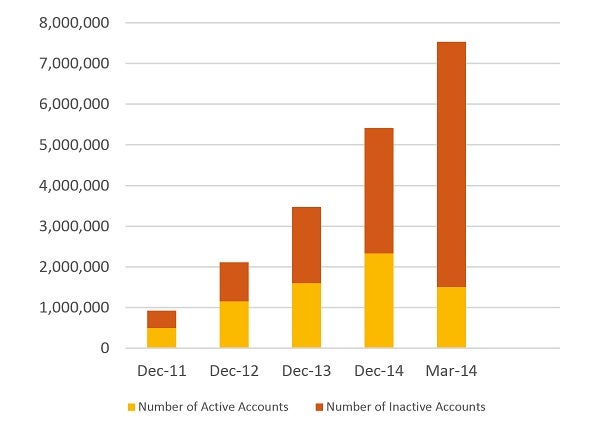

The initial impact of these new regulations on mobile wallet uptake can be seen in the latest branchless banking numbers released on September 17 2015 from the State Bank of Pakistan for January – March 2015. According to the report, there are now 7.5 million registered mobile accounts in the country, indicating a dramatic 39% increase since December 2014. Though it is clear that the regulations have succeeded in their aim which was making mobile wallet account opening easier, digging into these numbers reveals some worrying facts. Only 1.5 million wallets of the new and improved total are actually active (i.e. have been used on a 180 day basis according to SBP’s definition). In fact, in absolute terms the total number of active wallets has decreased by over 800,000 since December 2014.

Fulfilling the promise

It is clear that the overall number of active mobile wallets need to be increased substantially especially in light of Pakistan’s universal financial inclusion goal. While recent regulations have played their part in easing mobile wallet opening, unfortunately these regulations have not been complemented by actions to ensure that potential customers are made aware of the value of mobile wallets, and are actively using these accounts. Going forward, encouraging active uptake needs to be the focus of the mobile money industry. In the continuing series we will explore some opportunities related to this goal.

For more information about opportunities to increase mobile wallet uptake, please refer to "Using Mobile Money to Promote Financial Inclusion in Pakistan," by Karandaaz Pakistan.

Comments

From the perspective of an

From the perspective of an Indian financial inclusion observer, the blog, along the rereading of the major document from which it is drawn, offers interesting glimpses in the successful mobile money journey undertaken by Pakistani authorities. The continuous tweaking of the policy by State Bank of Pakistan has helped enormously in smoothening the mobile money journey.

I personally think that the thought of expecting mobile valet having greater success against agent based over the counter may not prove successful. Our cultures have for centuries relied upon the assurance of physical presence, for example, post men, or arhatias / middlemen, which have been expected to derisk the transactions, many failures not withstanding. For the poor and illiterate anything owned by government or approved by it or its agency say SBP is worth weight in gold. Hence the onus of keeping the channels honest squarely falls on the government authorities.

Utilising the large mobile networks and their agent networks will always be very alluring, but there needs to be efforts for upgrading the agent networks so that they are able to replicate the work of a small bank branch.

A model where the agent and bank official can jointly work can offer an alternative to mobile networks. As a survey reports- people are more involved in borrowing and saving- while the mobile networks are oriented towards remittances, etc.

The blog serves a useful purpose of updating present understanding of mobile money successes in Pakistan.

This is indeed an interesting

This is indeed an interesting analysis/study. With the support of Pakistan's bank regulator (SBP), this alternative method of moving money using digital platforms has now taken firm roots in the country. Of course, the next step of moving from OTC to digital wallets would be a little more tedious and tricky, given the culture, education level and trust in service providers. Not unusual though, and not something that cannot be overcome through educating the end users. Indeed, CGAP, IFC and IBRD are playing a big role in ensuring that this happens sooner than later.

Add new comment