QR Codes and Financial Inclusion: Reasons for Optimism

We have been here before. A new acceptance technology is about to take the world by storm and facilitate widespread electronic payment adoption among the unbanked. At various points in time, cards, mobile phones and near-field communication (NFC) were said to have the potential to advance financial inclusion. Today, it is QR codes. Will it be different this time?

In a previous blog post, “Inside QR Codes,” we noted that QR codes are gaining traction in China as an acceptance technology for proximity payments even at low-income merchants. However, it is unclear whether QR codes will reach the same adoption levels in other countries. It is also unclear whether the adoption of QR code payments will impact financial inclusion in these countries by enticing low-income customers to use other digital financial services.

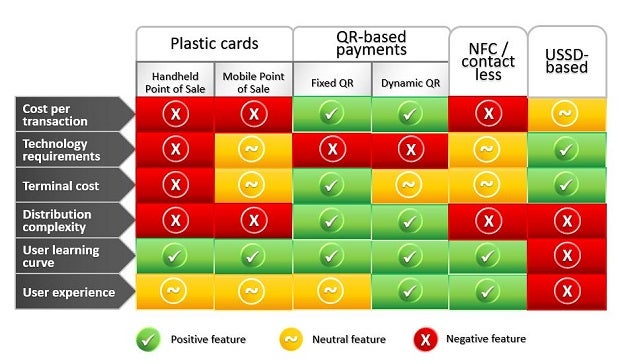

Despite the uncertainty, there are reasons to be optimistic about the future of QR codes. Acceptance technologies are evolving rapidly, especially in countries where traditional payment networks have not yet achieved a dominant position. The table below qualitatively compares common technologies for proximity payments in developing countries.

While each technology has its pros and cons, QR codes seem to be a promising way to digitize payments at low-income merchants and get customers to go digital. This may be due to a combination of three factors:

- QR codes make it easier to increase the size of acceptance networks. Transactions using QR codes are cheaper and simpler for both acquirers and merchants. Acquirers benefit from lower operating costs because they do not need to deploy a point-of-sale (POS) terminal for every merchant. Retailers save the POS cost because they can use the smartphone they already own as a QR code payment acceptance terminal; for those without a smartphone, a printout of the merchant’s QR code identifier pasted on the shop’s wall will suffice. QR codes are already stimulating growth in acceptance networks. In India, PayTM launched a nationwide campaign to promote the use of QR codes, waiving the fee banks charge merchants to accept card payments. With this promotion, PayTM aims to have 10 million merchants accepting QR codes by April 2018.

- QR codes provide an elegant solution to the card distribution challenge. Delivering debit cards presents providers with a major distribution challenge. Card and PIN must be mailed to recipients through two separate mailers. This is complex and expensive when targeting low-income customers, who often lack a proper street address. When a customer uses a QR code to make a payment, his or her smartphone replaces the card, removing the need for the multi-step physical mailing process.

- QR codes offer a user experience at least as good as cash, if not better. Users do not need financial education to use QR codes for payments. They simply launch an app, scan a QR code and enter their e-PIN. If using a printed QR code, they also enter their transaction amount. The fact that a user’s phone vibrates when a transaction is completed, and that he or she gets a visual receipt on their phone, adds immediacy and physicality to the payment experience in a way a card purchase never could. And the effort required of the merchant to complete a transaction is close to zero. Merchants simply need to show the QR code to the customer using their smartphone or a printout. They can serve another customer while processing a QR code payment like they do during cash transactions. This is an important requirement for small merchants in developing countries.

These factors make QR codes a potential game-changer in retail proximity payments, and this may have real consequences for large-scale adoption of digital financial services among financially underserved populations. Retail payments are used multiple times a day, whereas other financial transactions — cash-in, cash-out, remittance — are used usually once a week or every few weeks. Given their frequency, retail payments have greater potential to get people into the habit of using digital financial services.

On the flip side, for customers to see value in making their everyday purchases digitally, the number of merchant points needs to be an order of magnitude greater than that of agents. Looking at China and India, service providers seem to be willing to take on the challenge of scaling up QR code acceptance networks. QR codes also open new possibilities for fraud. For instance, scammers can replace a merchant’s QR code printout with a fraudulent one that redirects customers to phishing or other unsafe sites. These risks can be mitigated by imposing transaction limits and including fraud detection mechanisms in apps that rely on QR code-enabled payments.

QR code transactions connect the virtual and physical world in a novel and involving way. Such easy and widespread opportunities to make digital payments — the promise of QR codes — can bring lasting and profound behavior change among low-income customers and merchants, making formal payments a part of their everyday lives. Over time, transaction histories and alternative data trails can bring access to credit and other formal financial services, creating a gateway to financial inclusion.

Comments

I am one of the readers of

I am one of the readers of CGAP. Thanks for this research.When we talk about Financial Inclusion and new acceptance technology we try to highlight the context and environment of unbanked and low-income people.Those two situations are linked and interact sometimes by cause and effect. Of course the Quick Response Code payments can solve some problem if it is one of alternatives chosen to mitigate the huge challenge of poverty in some parts of the world. In my opinion I think the problem of poorest countries like Central African Republic, Democratic Republic of Congo,Malawi,Burundi,Liberia,Niger,Mozambique,Eritrea,Guinea, and Togo will not be solved by QR code. Why? They have more political and economical issues. Thus, based on this research we can be optimistic about QR in some countries but for others we need to work hard and to suggest others approaches. Warm regards.

Add new comment