Are Open Platforms Smart Business for Payments Providers?

The benefits of open APIs for third-parties who develop financial applications are fairly straightforward: they get greater access to “digital rails” that reach millions of customers and can more easily develop new products. Likewise, the benefit to poor customers at the other end of the rails is clear: greater access to financial and non-financial applications gives them better choices to address their needs and improve their lives. But is there a case for payments providers to adopt open APIs?

Going open involves working in a more complex operating environment. In addition to serving traditional end-users, an open platform needs to serve the developer community that brings new products to market through it. This involves developing streamlined IT interfaces as well as commercial and operational processes focused on this community. There are also reputational risks to consider if, for instance, a particular third-party application pursues some questionable end. Providers can address such issues and adequately mitigate risks, but the fundamental question remains: Is it all worth it? Is there a case for transforming into an open platform? We’d say yes.

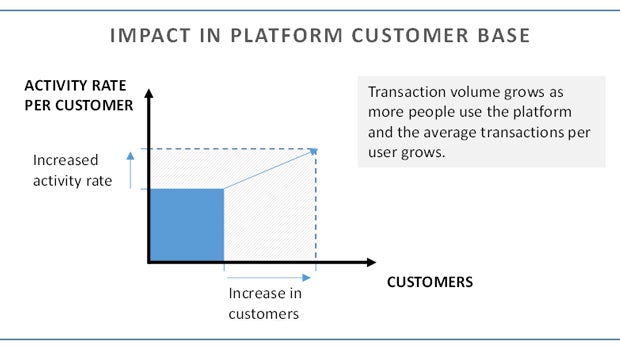

First, an open payments platform can attract more customers and increase their activity rates. While it is difficult to predict the impact for any particular company in going open, it is not far-fetched to think that new applications around digital wallets (adding features to existing use cases, bringing new payments use cases, or offering additional customer-facing value propositions) will generally attract new customers. One can also see how customers would be more likely to use their wallets if additional features made their wallets more useful.

Increased wallet usage brings account stickiness and activation, which increases value for the platform and its core services. A good example is Walgreens, a pharmacy chain that provides photo printing services in the United States. Walgreens’ open API service enables third parties to offer convenient photo printing features from the web. These features have, in turn, allowed the company to grow its business and improve customer engagement in its retail stores.

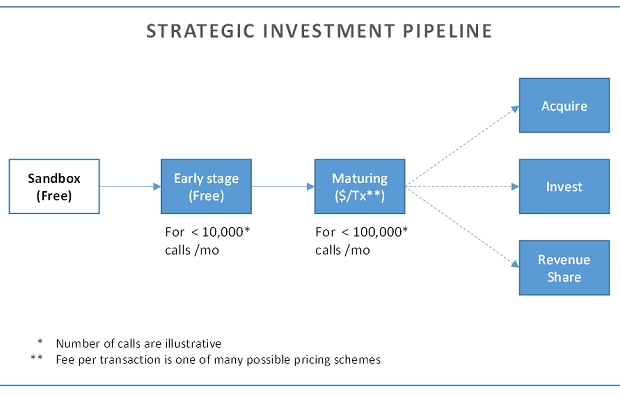

Second, an open platform produces incremental revenue by selling its API services. There are different ways to make money. Some providers charge developers every time they access an API, charging different rates based on the type of API or how frequently the provider accesses it. Others pay developers for extra clients they bring or for generating extra sales. Others charge a percentage of the money exchanged in each transaction. Lastly, some set up ad hoc revenue sharing schemes adapted to the application. Each of these approaches offers a revenue upside for a platform that goes open. Google Maps is a good example. They offer a variety of open API services with different pricing schemes based on the type of application Google Maps is used for.

Third, an open platform generates data and enables related investment opportunities. Open platforms can track customers’ behavior across a range of solutions and more easily develop customer insights, creating opportunities to improve existing value propositions or design new ones. Furthermore, an open platform can help businesses to identify early on which applications build customer traction and inform decisions about when it is time to invest in a business or acquire it.

Expanding what is possible with a digital payments system

A tailored API strategy can help a payment platform provider maximize value through these three areas. One example is a strategy that maximizes innovation in customer facing value propositions. Under this strategy, the platform provider gives entrepreneurs with low transaction volume free access to APIs. Once a new application begins reaching critical mass, a pricing scheme kicks-in. This allows entrepreneurs to fine-tune their value proposition before having to charge their customers and ensures that applications that get traction in a market develop a sustainable revenue model. Over time, some applications may reach a high number of customers. At that point, the platform can consider its options, such as buying or investing in the company or seeking a revenue sharing scheme. It was this kind of API strategy that led Twitter to acquire TweetDeck.

Innovation fueling growth for the long term

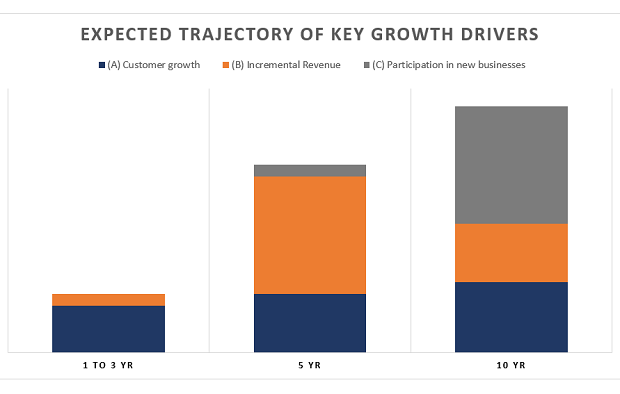

These options force us to take a long-term view. If a provider opens its platform today, how would its profits reflect the value of its ecosystem? Below is a hypothetical illustration of what the trajectory could look like.

In the above scenario, apps proliferate in the first few years. While most are free or generate income at very low rates, they drive business growth by expanding the customer base for the company’s traditional platform. In the medium term, incremental revenue from select, maturing third-party applications starts to accumulate. This is because the early years churned out unsuccessful solutions and helped a few mature value propositions to achieve critical mass, the sum of which now generate revenue at a relatively low marginal cost. Lastly, in the long term, some form of participation in third-party businesses would create significant value for the platform.

Will open APIs take off in digital finance space?

This is an enticing vision for any payments provider with a sizable customer base and the desire to fill a unique position in its market ecosystem. But will this vision be enough to motivate providers to transition to open platforms? Will the potential benefits outweigh risks? Will there be early pioneers in digital finance willing to find out? We certainly hope so. The poor have many unmet financial needs that require just the kind of innovation open APIs can unleash.

Add new comment