Digitizing Agriculture Value Chains: Seasonal Cash Flows

It is universally accepted that financial accounts are managed monthly for many good reasons; most salaries are paid, bills become due, taxes extracted, etc on a monthly basis. There are a few outliers like weekly wages or quarterly bills, but these can be made to fit into a monthly accounting cycle with little effort. This system works well for everyone, apart from the half of the population in emerging markets that are farmers.

Examining the cash flows of coffee and sugar farmers in Uganda for a CGAP-commissioned project revealed a seasonal cycle that is quite unsuited to monthly accounting practices. This is a problem because financial services operating on monthly cycles do not meet the needs of people with a seasonal cash flow. Even entry level bank accounts are geared towards monthly activities, and those that are unused for 3 - 6 months (by no means unusual for a farmer) are considered dormant, and may be frozen so that they cannot be accessed until their owner visits the bank in person to explain his inactivity – a long and expensive journey for most rural dwellers, and a requirement that can readily be removed with a little understanding of the customer’s circumstances.

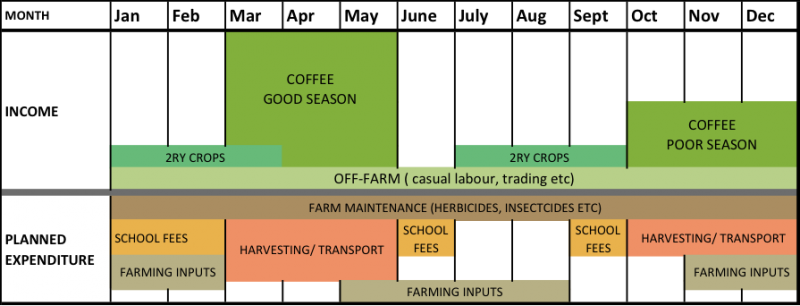

Inactive or dormant accounts are a major problem for financial service providers because they have incurred the cost of recruitment but are not getting a return on that investment in the form of either deposits held or transaction fees. This makes recruitment of rural customers unattractive: they are generally hard to reach with low population density, low income, and to cap it all off, seem to have rather higher than average inactivity levels. But many of these seemingly inactive customers are actually wrongly categorized – they are in fact intermittently active, depending upon the season. An analysis of their cash flow explains this. Coffee farmers in Uganda have two harvests per year, a good season and a poor one. The timing of these harvests depends upon the area of the country, the type of coffee grown and the weather, but can generally be represented by the figure below. To supplement their income, farmers also grow subsistence crops such as maize, beans, and bananas and sell the surplus. Some also have other jobs such as casual labor. This leads to a small ongoing income with major spikes during the harvest.

It is clear from this diagram that there are periods when the farmer is cash-rich and others when he has little or no income. During the lean times, it is hardly surprising that his bank or DFS account remains dormant; but it would be shortsighted to imagine that this means he has no interest in or use for his account. On the contrary, faced with the challenge of managing a cash flow with a few weeks of savings and year-long expenses, a farmer would find that suitable financial services could be of great assistance if designed in sympathy with the realities of a seasonal income.

Managing a limited and periodic income such that it lasts for the full year is a hard task, and many farmers interviewed admitted that they over-spent during the harvest and had to borrow during the lean times each year. In this situation, one of the first compromises made is to reduce spending on farming inputs, leading to lower yields, lower future income, and a downward spiral.

There are many ways that financial services could be designed to assist farmers to manage their cash flow, including:

- The establishment of credit ratings based on farmers’ non-standard financial circumstances rather than a conventional monthly rhythm;

- Developing loan products aimed at farmers whose terms again match those rhythms.

These measures could enable farmers to access event-based loans such as the purchase of agricultural inputs and the use of insecticides, as well as the more general but still problematic payment of school fees. The demand for safe, interest-bearing savings and for business loans was high amongst the farmers we met, and several had relationships with local MFIs or SACCOs.

Creation of suitable products that could be accessed by DFS would be a major step towards universal access as a means of controlling irregular cash flows. It would also have benefits for the banks that adopt this approach as it would allow them to create profitable financial products that provide a close fit to the farmers’ non-standard circumstances.

Comments

Though this is from Africa

Though this is from Africa but situation is India is also same where most of the farmers earn in two seasons of Rabi & Kharif but expenses are round the year. Almost all the farmers are up for credit at the start of farming season for inputs. Reasonably Priced Credit is not a commodity for poor people, hence they end up with Loan Sharks. An habit of targeted need based saving has to be there.

Upcoming Payments banks can help in bringing this behaviour change in farmers by creation of innovative & attractive saving products like "Save amount after Rabi's harvest and payout would be at the time of Kharif's input", lock-in of 3-4 months. This will help in changing behaviour of farmers and may be in long run farmer may become self sufficient (No need for credit) for inputs for farming.

I have not thought of any ill-effect of this, but researchers can help me in understanding other (Darker) side of this.

thanks

Add new comment