Top Five Takeaways from CGAP’s 2015 Funders Survey

Since 2008, CGAP has conducted an annual survey that tracks cross-border commitments from the largest international funders of financial inclusion. MIX has supported CGAP in conducting the survey since 2012.

We recently published the results from the latest survey, which reported commitments as of December 2014 and revealed that funding for financial inclusion was stable in 2014. In this blog post, we’ll cover the top five takeaways from the latest data.

1. Funding plateaued, but funders report they will increase or maintain current levels

After steadily increasing in previous years, international funding of financial inclusion is estimated to have stayed constant in 2014 at $31 billion. The euro’s decline explains part of the stagnation in funding, since about 40 percent of the funding in our survey comes from euro-zone funders. But even using 2013 exchange rates from before the euro’s devaluation, commitments grew by just 3 percent, which is still lower than growth rates in previous years (e.g., 8 percent in 2013 and 13 percent in 2012).

Despite the slowed growth in funding in 2014, the majority of funders told us that they expect their commitments to increase or remain at current levels going forward.

2. Funders report difficulty internally promoting financial inclusion

Each year, we ask funders about the top challenges they face in their financial inclusion work. In the last two surveys, covering data from 2012 and 2013, funders consistently ranked “adapting our strategy” as their top challenge. This year, funders said that the rise of other global priorities made it harder to promote financial inclusion within their organizations. Indeed, the international aid community has increased its focus on areas such as climate change, migration, and fragile states, which might draw resources away from financial inclusion. On the other hand, funders increasingly emphasize that financial inclusion can serve as an enabler of other development objectives, citing the increasing overlaps between financial inclusion and other priorities. These overlaps include green inclusive finance, mobile money for refugees, and financial services in the context of conflict.

3. Funders continue to focus on retail and use debt

Despite the changes mentioned above, trends in commitments didn’t change much from previous years, with retail-level financing continuing to make up the majority of international funding. About 70 percent of overall funding is used to finance the lending portfolio of financial service providers (FSPs).

Similarly, debt continues to dwarf the other financing instruments used by funders in the sample, reflecting the focus on FSP financing.

4. Funding to MENA increased significantly

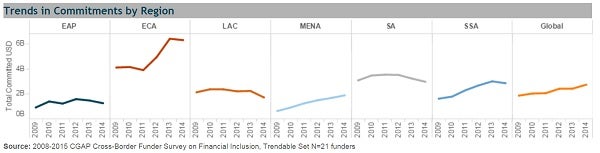

While it didn’t receive the largest amount of funding, the Middle East and North Africa (MENA) saw the largest growth in funding in 2014, an increase of around 12%. Funding to other regions either decreased or stayed the same, with Eastern Europe and Central Asia (ECA) continuing to receive the largest amount of funding. When asked about where they plan to increase their allocations in the next three years, funders reported a strong focus on sub-Saharan Africa (SSA).

5. Funders are investing in digital financial services and plan to support payment systems and consumer protection programs

The survey tracks which projects integrate digital finance, an area of growing importance for financial inclusion. Funders reported a total of 97 projects aiming to expand digital financial services for the poor. More than half of these projects target SSA, and foundations and multilateral agencies are providing the majority of the funding. Going forward, funders report that they will continue to focus on supporting FSPs, but they also plan to fund payment systems and consumer protection programs.

Comments

Funders is not the key but

Funders is not the key but financial institutions or MNO. Unless we make this financial inclusion a pure business opportunity for providers this will be like environmental and climate change funding without considering environmental issues as managing variables for the business. Business is the only driver to make this work. Financial Inclusion and inclusive finance will work when we only approach it as a business. Very low margin and high volume but a business. What really surprises me is that a lot of people keep talking about MDG and stuff like that that althoug being extremely important the do not provide any return. In fact the icon of M-Pesa or b-kash are so successful because the are managed with a pure business perspectives. The private business are the ones that will solve the problems of our societies. No one else can but business. Some people like to talk about impact investment. This is what business do: pure and simple social impact.

Add new comment