Transforming Payments through mPOS: Perspectives from Indonesia

We recently traveled to Jakarta, Yogyakarta and Bali to talk with over 40 traditional merchants, including restaurant owners, transport and tourism providers, and other micro and small entrepreneurs who typically handle cash transactions daily with their customers. While electronic transactions have a range of benefits for the poor, few of the traditional merchants they frequent in Indonesia accept digital payments. Through in-depth interviews, we sought to understand why and determine how mobile transaction devices could help better serve their needs – and their customers. We also wanted to know why merchants have not accepted digital devices already, and what would motivate them to do so?

The merchants we interviewed used mainly cash or traditional transaction devices, known as point-of-sale (POS) devices. POS devices are relatively expensive tools to process credit and debit card transactions. Mobile POS devices (mPOS), on the other hand, utilize smartphones to process digital transactions. They are mobile, utilize wireless networks and are significantly cheaper than traditional devices, making them more accessible for smaller businesses.

While still a relatively new technology, we are beginning to see significant mPOS uptake among small merchants in certain markets. In the United States, for example, Square’s network of more than 3 million users and 250,000 merchants transacts more than $15 billion annually. By 2019, the global mPOS market is expected to grow fivefold to a total installed base of 51 million devices – representing 46% of the total POS device segment.

Despite their appeal and increasing use in certain markets, mPOS devices are not a common sight in Indonesia. In fact, neither are traditional transaction devices. Indonesia is a country where cash is still king: Over 99% of all transactions by volume occur in cash, and customers have a strong sense of where they should pay with cash rather than card.

Indeed, we estimate that somewhere between 600,000 to 1 million traditional POS devices are used in the country, or just two to four POS devices per 1,000 people. By comparison, Verifone, a leading global payments company, estimates that there are:

- 34 POS devices per 1,000 people in the U.S.

- 17 per 1,000 people in Brazil

- One per 1,000 people in India

Given the current penetration of POS devices and rapid growth of card transactions and smartphone users, our hypothesis was that mPOS devices could serve a growing market need for card acceptance, including for traditional merchants like restaurants, independent convenience stores and small retailers.

Why focus on traditional merchants?

While the number of modern retailers like convenience stores and super markets has been growing rapidly, traditional markets still make up the majority of retail sales and certainly are the most important in serving low income people. In Indonesia, it is estimated that there are at least 60 million micro and small enterprises (MSEs). Because their average transaction size and daily transaction volume are relatively low, many of these businesses are less interesting potential customers for banks, which means that they often do not already have POS devices.

The project’s core hypothesis was that introducing mPOS into the market could advance CGAP’s financial inclusion agenda. In addition, research found significant MSE interest in applications linked to mPOS, such as simple financial management tools, customer loyalty applications, transaction history and inventory management could improve merchant’s business processes and help them better serve their customers. We’re beginning to see this trend in developed countries, as Square, Verifone and other players are quickly moving beyond providing just an mPOS product to a comprehensive suite of service offerings.

Beyond this, mPOS-based solutions could increase customer access to financial services in a country where nearly 60% of the population remains unbanked. While there has been significant growth in bank accounts across Indonesia, access to and use of services beyond direct deposit of salaries and cash withdrawal has so far remained limited. With mPOS-based applications, merchants could offer fee-based remittance and online payments, for example (e-commerce in Indonesia is expected to grow to $5 billion by 2017). Looking forward, such transactions could create electronic footprints that make it possible to offer credit facilities to customers (Square recently announced it would start offering cash advances to its merchants).

Our findings

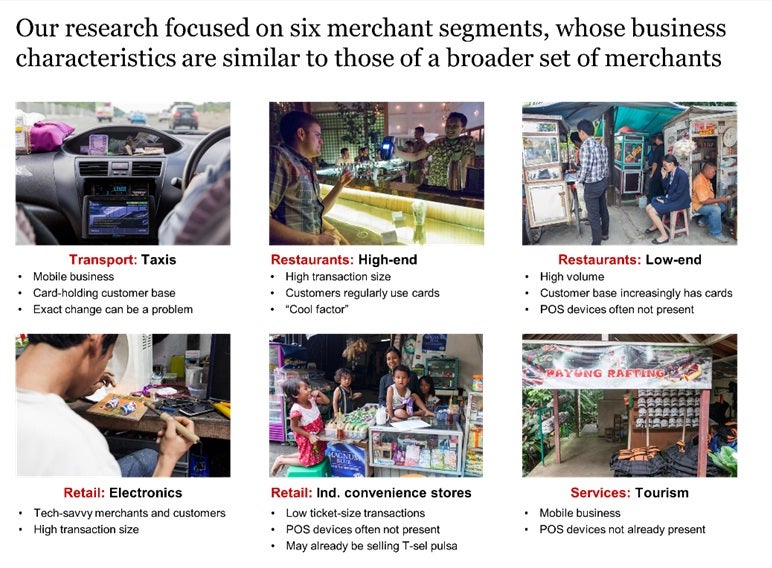

Since it was not possible for us to speak all types of traditional merchants, we wanted to select a broader set of merchants so that our findings would be more widely applicable. Based on a number of criteria, including importance of mobility to the merchant’s business, average transaction size and penetration of cards among customer base, we selected six traditional merchant segments to study in depth through human-centered design methodology.

While the responses varied significantly by merchant and merchant segment, three key themes emerged from our findings:

- Value-added services providing business solutions increase merchant interest in mPOS. Most of the merchants interviewed had already been offered traditional POS by Indonesian banks and were less interested in mPOS for its payment acceptance features alone. Many had POS devices that were infrequently used, others didn’t care about being able to accept card payments, and some simply believed the technology was too new for them.

Instead, we found that merchants are excited by value-added applications on the smartphone, such as data analytics, marketing and inventory management that are complementary to mPOS and provide business linkages to Telkomsel. Indeed, they saw these applications as potentially transformative business solutions. Specifically, they were excited by features that would improve business processes and relationships with customers.

- Merchants prioritize accuracy, speed and transparency. Traditional merchants were concerned about how safety, security, and network quality could impact their business and cash, as well as the need to build consumer trust in digital transactions. Their personal experience with dropped calls and lost SMS messages made them cautious about adopting a device that relies on wireless technology. This was especially true for rural businesses, where the signal was less reliable.

- Trust is an issue: Strong preference exists for at least a partial association with bank and transaction receipts. There is a trust deficit around security of new payment systems, especially those which are offered by telcos rather than banks. mPOS is seen as a money-related solution, and merchants consistently said that they would feel more comfortable if the product was offered by a bank instead of a telecom provider. Some merchants were comfortable with the idea of a co-branded product, given the offering also relies on wireless technology, which a telecom is better suited to provide than a bank.

We also heard stories about people who have fallen victim to SMS scammers and credit card manipulation. People fear that when they use a card they will be charged more than they should be without knowing about it. While this may largely be an urban myth, this concern was expressed by many of the merchants we spoke with. As such, many merchants specifically stated that SMS or e-mailed receipts would be insufficient and physical receipts would be an important part of any mPOS solution. Similarly end-clients have trust issues with traditional merchants, which they consider less professional than modern retailers.

While these findings are based on the local Indonesian context, some of the insights could be applicable to other countries. In our next blog, we will explore how to translate these findings from the field to design a robust and relevant mPOS product for the traditional micro and small enterprises in Indonesia.

Comments

Useful perspective

Useful perspective

Gaurav, Swetha, thank you for

Gaurav, Swetha, thank you for this insightful post. All too often, discussion of mPOS is driven by theoretical rather than field evidence, so very much look forward to the follow up. One question I had was on the retailer sample set: I assume that all of the tested POS and mPOS devices required mobile data, meaning a bias towards urban centers/availability of 3G. In your view, does this skew the data set? Given that the vast majority of mom-and-pop shops will not have access to (reliable) mobile data connections, I wonder if there is an inherent bias in your findings?

Add new comment