Aggregators: The Secret Sauce to Digital Financial Expansion

Have you ever made a payment from the comfort of your home using a mobile phone? Maybe a power or water bill, or airtime top up? While it might seem that providers like MTN or Safaricom – or perhaps a bank - deserve the credit for this convenience, chances are you are also benefiting from the services of another key player in the digital financial ecosystem: an aggregator.

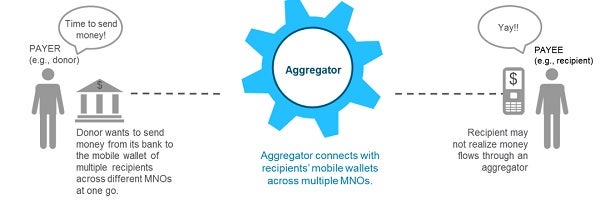

Aggregators can be thought of as the glue that helps many parts of the digital financial services ecosystem to work together. They allow payment instrument providers (like MNOs offering mobile money services or banks offering mobile banking) to easily integrate with entities that want to send money to or receive money from end customers. These entities can be utility companies who want to receive payments, businesses who want to pay salaries or donors who want to pay recipients, for example.

Aggregators mostly work in the background and although millions of transactions in East Africa pass through their systems every day, most customers (and even other actors in the ecosystem) are not even aware of their existence. Cellulant in Kenya integrates more than a dozen banks into M-PESA and Selcom in Tanzania has a sizeable percentage of all electricity payments going through their system – and yet their brand visibility in these countries is minimal. To fill in the information gap, CGAP embarked on a landscaping study to uncover more about who aggregators are, how they work and the role they play in the DFS ecosystem. We conducted more than 20 interviews across Kenya, Rwanda, Tanzania and Uganda and did some deep dive field visits to try understand how aggregators really work. We’ll share some highlights in a few blogs but check out the full deck for all our findings:

The definition:

At a basic level, all aggregators do two things – Integration, where they connect the systems of payment instrument providers to third party systems, and Value-Added-Service (VAS) like notification of successful payments, reconciliation, and receipts. At any given point, an aggregator is integrating at least 3 types of actors:

- The payer (one who pays, such as an end customer who wants to pay an electricity bill or donor who wants to send payments to recipients);

- The payee or recipient of payments (to whom a payment is made, such as an electric company or recipient of a donor payment); and

- The payment instrument provider (such as an MNO or bank).

Without an aggregator, each individual integration between a payment instrument provider (such as a mobile money service) and a third party (such as a utility company) would cost anywhere between $15,000 to $30,000 and take 4-6 months. In addition, it would require investments in customer support and troubleshooting of technical challenges. Many mobile money providers have chosen to use aggregators to avoid these upfront investments, long timeframes and the onerous tasks of managing reconciliations, payment disputes and customer support.

The typology:

Mention aggregators in East Africa and you will hear a variety of definitions ranging from companies who recruit merchants to companies who run switches to companies who are building out their own agent networks. The types of aggregators we’ve been talking about can loosely be called payment aggregators, and these were the focus of the study. Payment aggregators ensure the seamless flow of payments between payers and payees across multiple payment instrument providers. Irrespective of which payment instrument an end customer decides to use to conduct a transaction (a mobile wallet on any network or a mobile banking app), the payee is able to receive funds.

Most payment aggregation services work in the background, that is, they don’t directly engage with end customers. In most cases, the end customers do not even realize an aggregator is part of a transaction at all. Common back-end transactions that aggregators facilitate are remote bill pay, bulk collections, bulk disbursements and account-to-account (e.g., between bank accounts and mobile wallets). Examples of aggregators who work in the background of transactions include Cellulant (in Kenya) and Pegasus (in Uganda).

Example of back-end aggregation service:

While most aggregators are invisible, some do engage directly with end customers. This is becoming increasingly common as aggregators want to establish their own brand presence and move into areas like merchant payments. This front-end touchpoint could be through any consumer-facing interface such as a phone app, aggregator ATM, or aggregator agent. Examples of aggregators who have front-end presence include Selcom Wireless in Tanzania and Pivot in Rwanda. For example, at Selcom Paypoint point-of-sale (POS) terminals, customers can buy airtime, pay utility bills, cash-in and cash-out of mobile wallets, buy goods in stores and pay for bus tickets.

Example of front-end aggregation service:

Now that we’ve covered a quick overview of what aggregators are and how they work, our next post will tackle the business of running an aggregator. How did aggregation companies start, what is their size and reach, and what are some key components of their business model?

Comments

Great insights into financial

Great insights into financial Inclusion. thanks.

Perhaps one aspect that i may

Perhaps one aspect that i may add to the mix as functions of aggregators is unification. This is taking multiple and at times competing products and services and piping them to payee company in one pipe. Thus abstracting the complexities of individual integrations. i.e unify payments across MPESA, AirtelMoney, Equitel etc

I wish similar study should

I wish similar study should be done in India. After demonetization, the role that will be played by the aggregators is to be understood. However, should we require a regulator for the same? Yes.

Add new comment