Can Funders Afford to Ignore Gender Norms in Financial Inclusion?

Recently, we were asked by a funder whether financial inclusion actors should get involved in addressing gender norms, which are so pervasive and embedded in cultures across the globe. Our response – “Can you afford not to?”

As a recent blog from CGAP and CFI highlights, inclusive finance is affected by and affects gender norms. Gender norms create an uneven playing field and a financial system where women do not have the same access and opportunities as men. If funders want to go beyond closing the gender gap in access and build more equitable financial systems that benefit women, their households and economies, they need to intentionally address gender norms.

With that in mind, it’s not a question of whether funders should get involved, but rather how best to do so.

Why isn’t the system working for women, and what needs to change?

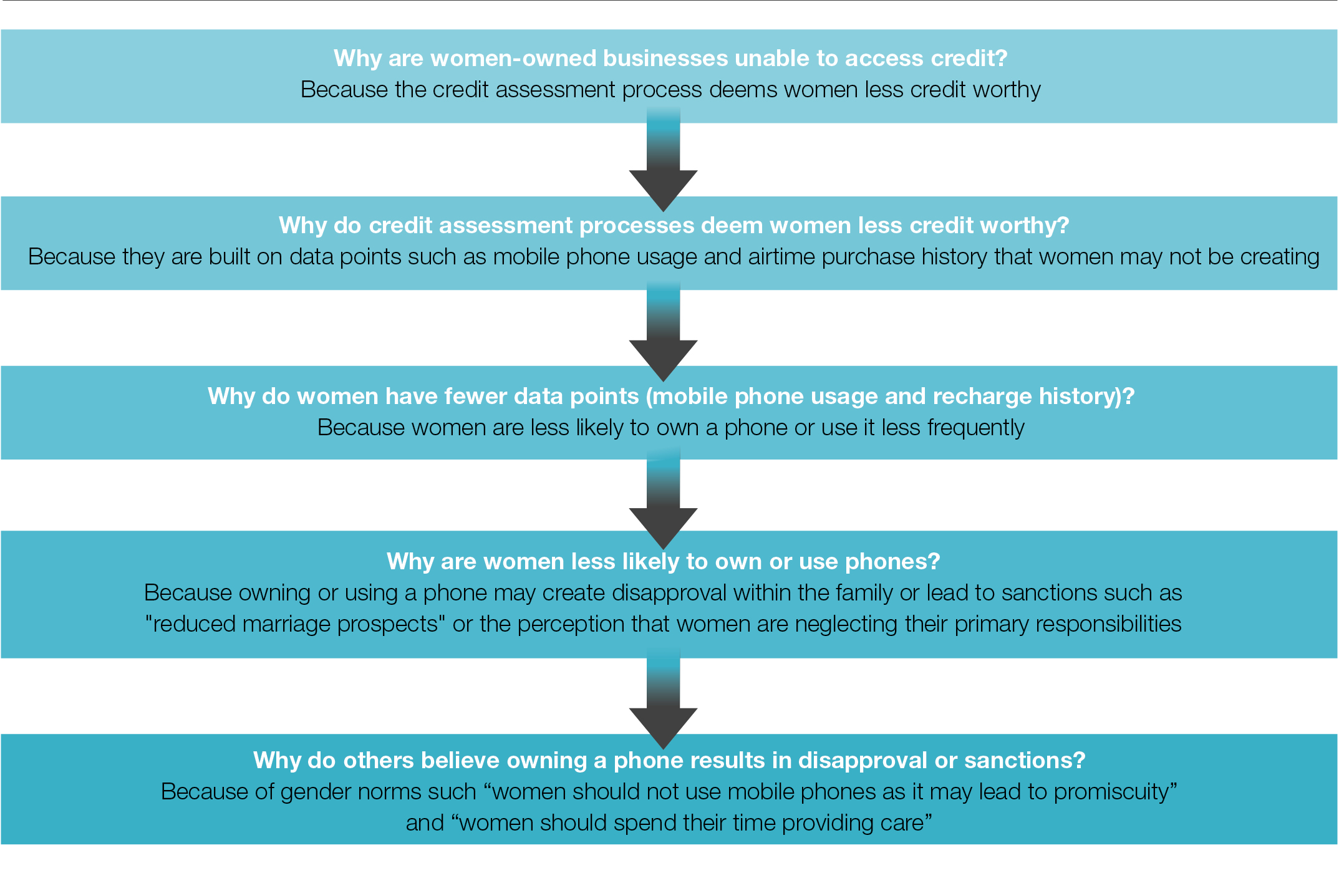

Like any market systems development effort, the first step is to understand why the financial market system is not working for women. This analysis should go beyond just looking at women’s behavior, aiming instead to understand what is driving that behavior as well as the behavior of other market actors. The root causes of market constraints often lie in norms that affect all actors of the market system – women, men, financial service providers (FSPs), regulators, policy makers, support function providers and others. Using a tool such as the 5 Why’s (often used in market systems development programs) can help in identifying the root causes of a particular behavior as outlined in the example below (which asks why women owned businesses are unable to access credit).

CGAP and FinEquity are currently facilitating a collaborative learning effort of six funders and market facilitators that are diagnosing gender norms affecting women’s financial inclusion in Bangladesh, India, Malawi, Rwanda, Tunisia and Zambia. This effort is following a similar diagnostic approach to identify gender norms affecting women’s financial inclusion as CGAP and MarketShare Associates (MSA) used in Turkey and Egypt. The diagnosis does not only identify and prioritize norms to address, but also looks at which norms might be relaxing or open to change versus others that are stickier and will be harder to address in the short run. For example, the COVID -19 pandemic is leading to higher digital financial services (DFS) usage rates among women and greater social acceptability of women using DFS without fear of sanctions.

Biases about what women should or should not do are often unconscious. They may affect the behavior of policy makers, bank staff and technical service providers without them noticing. Based on the insights about how gender norms impact the behavior and underlying incentives and capacities of different actors, funders and facilitators can determine a vision for change and design interventions to facilitate that change.

Designing for impact: facilitating change

As the previous example of COVID-19 leading to greater acceptability of women's DFS usage demonstrates, norms can and do change – and the market diagnostic can help identify the entry points and opportunities for change.

Addressing constraints rooted in norms requires working with a range of stakeholders in the financial market system to understand their incentives and capacity to change their behavior. Whenever possible and desired, interventions should help shift harmful norms in favor of greater gender equality. This may necessitate partnership with actors outside the usual financial inclusion stakeholder arena, such as women’s empowerment advocacy organizations or women’s entrepreneurship associations. Interventions that have seen some success have drawn on experiences in other sectors (e.g., reproductive health). Other examples include leveraging champions and role models for women’s economic empowerment in organizations through public campaigns and engaging men in the conversation.

In CGAP’s Technical Guide “Addressing Gender Norms for Women’s Financial Inclusion, Designing for Impact,” we included several examples of interventions that take norms into account ("norm informed") and some that tackle harmful norms in order to advance women’s financial inclusion and economic empowerment (“norm transformational”).

A recent example of this is GIZ’s Her & Now project in India, which works to address gender norms limiting women’s entrepreneurship. A collaborative effort between GIZ and the Indian government's Ministry of Skill Development and Entrepreneurship runs incubation and acceleration support programs for India's women entrepreneurs. The programs equip women with critical business skills, access to market opportunities and peer networks, linkages to financial institutions and customized support through mentorship. It also includes a media campaign which focuses on raising awareness and facilitating attitude change around women’s entrepreneurship. Using a series of films and facilitated dialogues, the campaign highlights the positive contribution of women entrepreneurship for the Indian society and economy using real-life stories of relatable role models. As of 2021, 700 entrepreneurs have been supported through two rounds of incubation and acceleration across 3 states. The Her & Now online campaign has reached over 325,000, and approximately 7,300 people have watched and engaged with the short films. There is interest in scaling up the intervention in more states over the next few years. While it might be a while before the program can measure changes in attitudes toward women’s entrepreneurship, the effectiveness of media campaigns to address social norms is well documented.

Other examples from the financial sector show how considering norms in design of products, delivery channels and FSP policies can have a positive effect.

For example, in Kenya, Women’s World Banking worked with Kenya Commercial Bank (KCB) to address constraints on women’s access to credit due to a lack of collateral. While women have de jure property rights in Kenya, de facto norms imply that women are unable to exercise these rights. KCB adapted its credit assessment process to a cash-flow based model that gives banks more visibility of the true size and potential of the businesses in question. More than 500 relationship managers were trained in the new methodology and received exposure to women’s businesses. The proposition supported a more thorough and accurate evaluation of credit worthiness and allowed for stronger risk assessment. The broader strategy to developing a tailored value proposition for women-owned MSMEs has shown positive results, with women accounting for 51% of the KCB’s MSME loan portfolio, up from 22% in 2015. While the gender norm that “women should not own property” was not directly tackled by this intervention, the shift in the portfolio may contribute to a change in perception among bank staff of women-owned business and their creditworthiness.

Gender norms are both embedded in institutions and nested in people’s minds

It is critical that funders and facilitators consider this as they engage with partners, work to incentivize them and build their capacity to affect behavior change for a more equitable financial system. CGAP will continue to lead this learning effort to gather evidence on what works and what doesn’t in contributing to this change.

Gender norms create a financial system where women do not have the same access and opportunities as men. If funders want to go beyond closing the gender gap in access and build more equitable financial systems, they need to address them.

Add new comment