Inclusive Growth vs. Household Finance: A False Choice

Called one of the critical challenges of our time by former IMF Managing Director Christine Lagarde, inclusive growth refers to sustained economic growth that is broad-based across sectors and allows most of a country’s labor force to contribute to and benefit from growth. At a policy level, the inclusive growth agenda has focused on creating jobs as the main route out of poverty. This emphasis on job creation has stirred up a debate about whether funders should direct their energies at expanding access to financial services for businesses instead of individuals. But this is a false choice. Although research on the impact of individual financial inclusion on inclusive economic development is still in its early days, recent findings suggest that there is a positive impact.

Several studies have found that financial inclusion contributes to economic growth. IMF examined 95 countries and found that not only did individuals’ access to and use of financial services promote growth, but it also decreased inequality, particularly when financial inclusion was in its early stages. World Bank researchers have found that improving low-income households’ access to finance in Mexico contributed to economic development and higher income for poor households by “fostering the survival and creation of informal businesses and by increasing employment.” While these are promising findings, other than the Mexico study, the evidence has not been clear on exactly how individual financial inclusion affects growth.

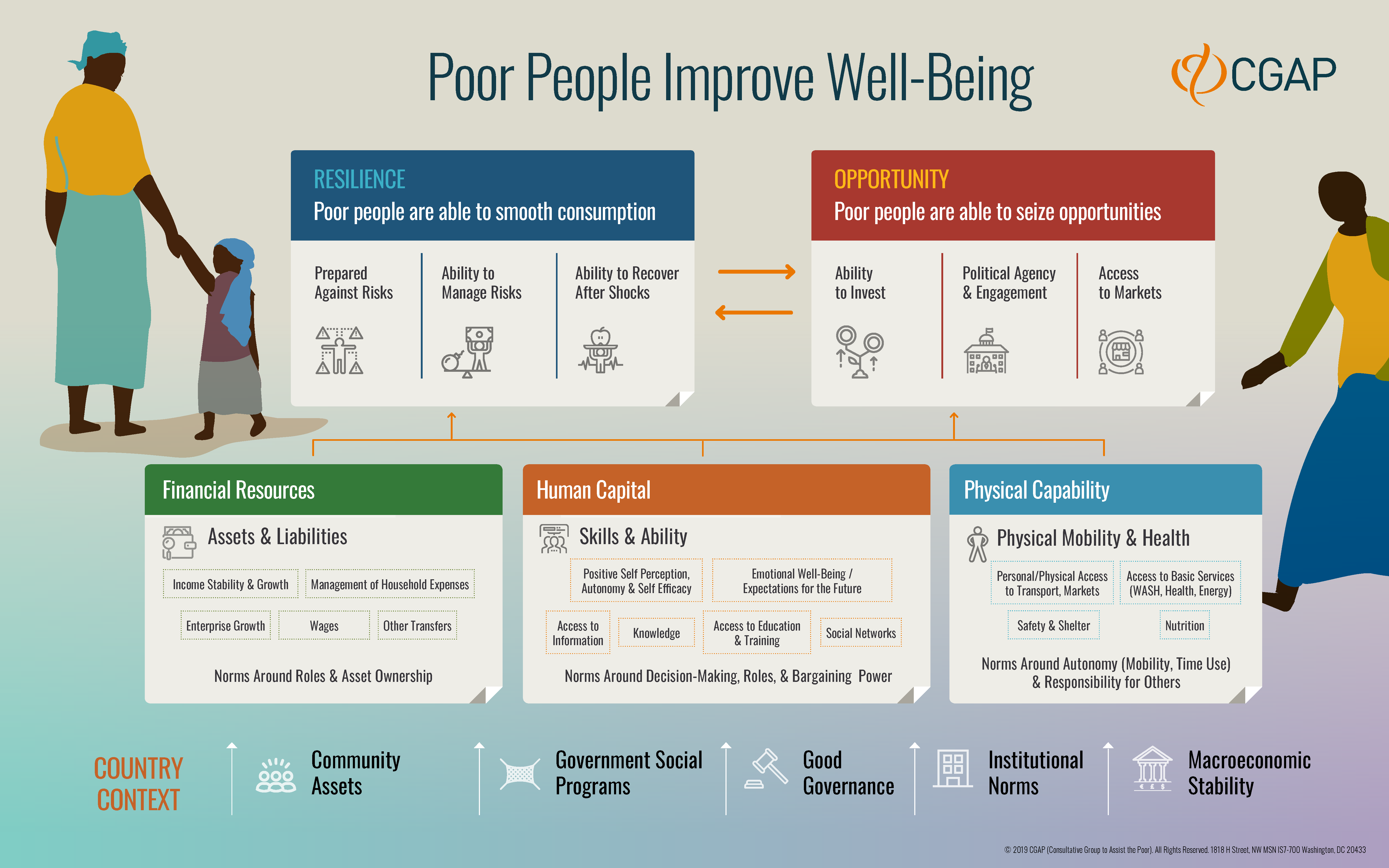

CGAP’s recently updated theory of change for financial inclusion points to some possible channels through which financial inclusion of individuals promotes inclusive economic growth. While it does not directly address broader economic growth — focusing instead on individual well-being — it lays the groundwork for imagining how individual changes might affect the economy. Specifically, the theory of change says that low-income people’s well-being is improved through two main pathways: building resilience and capturing opportunities. We can better identify channels to inclusive economic growth when individual results within these pathways are aggregated.

Increased individual resilience translates to aggregate demand at the macro level

Financial services enable individuals to prepare for risks, manage shocks when they occur and rebuild their lives after a loss. By allowing people to maintain consumption levels after a shock, financial services help to preserve employment and aggregate demand for goods and services. The use of financial services can enable people to migrate, diversify or increase their income; obtain remittances from friends and relatives for day-to-day needs or investment; recover assets through insurance claims and savings; and maintain business activities through credit. Insurance can allow people to invest more in productive activities. The more resilient individuals there are in a community, the more resilient the community. When more resilient communities can continue prior levels of consumption after a shock, they help to maintain aggregate demand, employment and GDP levels at the national level.

Recent research has shown us what happens to aggregate demand when financial services for the poor are withdrawn. India’s microcredit crisis in 2010 caused the Andhra Pradesh government to curtail all microfinance activities in that state. This negatively impacted the labor market, earnings and consumption, likely through a reduction in aggregate demand.

Capturing individual opportunity translates to increased productivity, investments and savings or consumption

Financial services enable individuals to capture opportunities through investing in human, financial, physical and productive assets. The use of financial services can increase self-employment and wage employment leading to improved incomes. It can support access to training or education and support investments in assets that improve health, sanitation and mobility, all of which can improve individual productivity. Through higher employment, greater productivity and improved incomes, individual-level achievements can contribute to inclusive growth through enhanced productivity, increased investment and increased aggregate savings or consumption. Of course, opportunities must be available for individuals to capture. Good governance, government social programs and supportive norms are among the preconditions for opportunities to exist.

Economic growth also requires enterprise finance and financial deepening

CGAP’s updated theory of change also highlights that, although individual-level finance can influence inclusive growth, enterprise finance is critical. The development of efficient financial intermediaries that adequately serve all types of enterprises — not just the largest ones — has a major impact on the extent to which growth can be inclusive. It also enables a more effective allocation of credit across the economy. Formal credit for microentrepreneurs has been shown to have persistent effects, including growth in business, employment, wages, business assets, revenues, expenses and profits. However, these effects have been found only for growth-oriented microentrepreneurs (i.e., entrepreneurs who start businesses even in the absence of microfinance).

The emerging evidence on the contribution of financial inclusion to economic growth is positive, but more research is needed to validate the channels through which this happens. This initial attempt to imagine how individual-level impacts translate into macroeconomic effects is only a first step. But it has left us with one clear takeaway: the debate about household finance versus enterprise finance is a false choice. Each is important for achieving inclusive growth, and therefore researchers and policy makers should explore how best to promote them both.

Add new comment