A Public-Private Partnership to Digitize Bus Fares in Rwanda

The government of Rwanda since 2000 has prioritized the building of a “knowledge-based economy” as articulated by Vision 2020. A couple of key milestones on the path toward this vision include digitization of government services and a population that is 90% financially included.

How can these ambitious milestones be met? A national payments ecosystem is a key ingredient for universal financial inclusion. Digitizing high-frequency or high-volume payment flows – especially to and from government – can expedite this.

The most recent FinScope survey from 2016 placed Rwanda’s level of formal financial inclusion at 68%. Based on this survey, CGAP estimates digital financial inclusion, measured by the number of active registered mobile wallets on a 90-day basis, at 22%. Efforts to grow these numbers via technology-enabled payment solutions are often presented as a “chicken-or-the-egg” dilemma: If customers do not demand alternative payment channels – usually because they see no compelling use cases – providers are reluctant to invest time and money in building the required infrastructure. However, without the infrastructure, customers never have the opportunity to try cashless transactions and therefore remain unaware of its benefits.

This makes initiatives such as Rwanda Online, a 25-year partnership between the government and a private company, even more important. It was established to develop technology-enabled delivery of government services and digitization of corresponding payments via platforms like IREMBO. Rwanda Online plans to bring 100 government services online over a period of three years. By maximizing digital payment use-cases, one aim is to create greater traction for financial products and services and thereby achieve greater financial inclusion.

In the same vein, the Rwanda Utility Regulatory Authority (RURA) in partnership with private bus operators is seeking to digitize bus fare payments. This use case is significant for several reasons. It taps into a large portion of the Kigali populace that overlaps with lower income segments. In addition, the industry is currently cash-intensive, lending itself well to a digital solution. And the service would be regulated by a government agency that would reap the cost-saving benefits of digitized fare payments in the form of increased tax revenue.

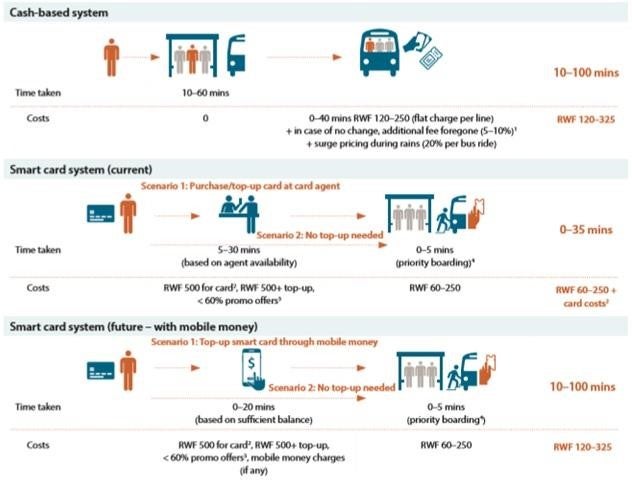

Kigali Bus Service (KBS) was awarded a multi-year contract in 2013 to provide public transport in the city. Following a one-and-a-half-year pilot, KBS rolled out the Tap&Go scheme. Riders pay their bus fare with a pre-loaded card, relying on near field communications technology, obviating the need for conductors to collect cash from riders. Currently, a rider can obtain and top up a Tap&Go card from any of the 45 agents around Kigali. The number of agents will increase in the future.

Within the first three months, KBS reported almost 70,000 active smartcards, which is approximately 20% of the bus transport market in Kigali. The benefits include:

- For customers, an immediate benefit was a substantial discount off the fare as part of an introductory promotion that may be revived periodically.

- The longer-term benefits will include time and money saved by being able to avoid situations where, for example, a bus conductor exploits inclement weather conditions to try and charge riders more or claims to not have the correct change.

- Customer convenience is also enhanced by a speeded up boarding process – sometimes shaving as much as twenty minutes off the total trip time.

- For the bus operator, between the months of January 2016 and February 2016, revenues increased by 140% due to the reduction in leakages.

- Digitizing payments has also yielded valuable insights on routes “leaking cash” and in turn, greater revenue predictability. Increased revenue for the operator means increased revenue for the government (0.8% fee of operator revenues as well as taxes). In fact, going forward it is expected RURA will mandate all bus fare collections to become “cashless.”

The scheme does face some challenges, however, that can hinder expanded usage. First, riders cannot use the Tap&Go on other buses operating in Kigali. That means customers who need to transfer from a bus route serviced by KBS to a bus route serviced by another company would not be able to use their card to pay for the entire journey. Second, the upfront costs for obtaining the card is equivalent to two or three rides, which might be out of reach for some poorer customers. Third, and most salient to the financial inclusion agenda, Tap&Go cards cannot be topped up from mobile wallets, but only in cash. However, a survey put the use of bill payments via mobile wallets at 25% in Rwanda, so clients are likely to be familiar with complex digital payments use cases which bodes well for scaling Tap&Go.

The key for operators and regulators, then, is to encourage integration of mobile wallets and use cases such as Tap&Go. The greater the integration and interoperability, the more compelled the customer is to store money in the mobile wallet rather than immediately cash out.

Add new comment