|

In recent years, digital credit has grown rapidly in developing economies. Industry standards and regulatory oversight mechanisms have struggled to keep up with this growth. (For a better understanding of how digital credit works, see “Digital Credit: A Fast-Moving Global Trend,” which explores digital credit’s early days. To learn more about the risks, see “Lessons on Digital Consumer Credit from East Africa.”)

Until recently, much of the activity and discussion around digital credit have centered on low-value, uncollateralized consumer lending. Meanwhile, interest in lending to MSEs—which could be an even greater revolution in financial access—has been brewing. “Bridging the Credit Gap for Micro and Small Enterprises” explores the potential size of credit to MSEs in emerging markets, outlines how digital technologies are disrupting this space, and describes the most promising emerging new business models.

Digital disruptions changing the landscape

The market opportunity for MSE credit in emerging markets is estimated to be $8 trillion, but more than half of it goes unmet. Lending to MSEs by traditional financial institutions in emerging markets and developing economies (EMDEs) has been extremely limited. Some of the key reasons include the high cost of customer acquisition and due diligence (especially for a segment that is largely informal or semi-formal), insufficient data to make accurate credit assessments, uncertain customer lifetime values, and the high costs of distribution and servicing. We estimate that there is a $4.9 trillion credit gap for micro- and small businesses in EMDEs, with the informal sector representing 30 percent of this unmet demand.

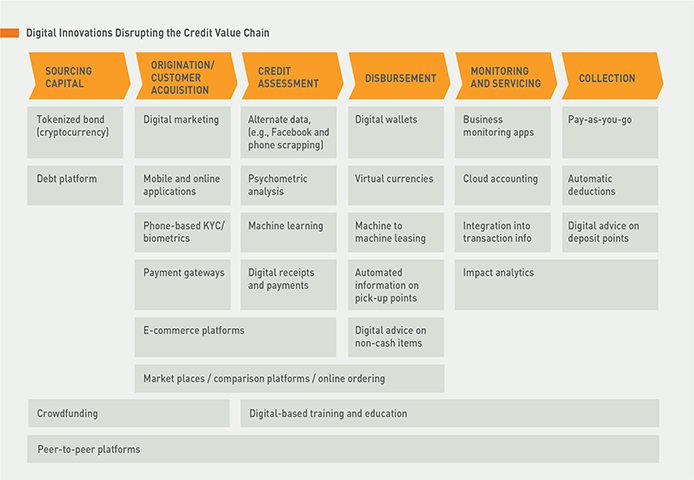

However, digital technologies are now enabling new business models that are better placed to respond to this opportunity and to disrupt traditional MSE financing models. The framework below lists six key aspects of a credit value chain—sourcing of capital by lenders, customer origination, credit assessment, digital disbursement and servicing, and collections—and identifies how various digital technologies are impacting every aspect of the chain.

The following are a few of the emerging business model innovations noted in the framework.

Sourcing capital. Lenders like banks and large microfinance institutions typically raise capital through deposit mobilization. However, this method requires them to invest in branch infrastructure that is costly and difficult to scale. Institutions that do not take deposits tend to raise capital from wholesale debt, which is more expensive than deposit mobilization. Moreover, financial institutions in EMDEs often struggle to source capital from wholesale markets because of low credit ratings and high country risk, which limit access and raise costs even further. The typical cost of traditional deposit mobilization ranges from 5 percent to 25 percent, depending on the market.

Platform-based capital sourcing such as peer-to-peer lending platforms or platforms that allow a composite of financial institutions and individual lenders to fund either individual loans or bundled loans, are emerging as strong alternatives. In the case of person-to-person transactions, the platform does not raise any capital because its role is limited to connecting individual investors to borrowers and, possibly, to assessing borrower risk and channeling the flow of money. The cost of deposit mobilization is not reduced for traditional lenders that choose to participate in such platforms, but there is a decrease in the cost of loan origination, risk assessment, and disbursement, allowing for gains that are then passed on to the borrower.

Origination. Finding new customers and selling them financial products also traditionally rely on expensive branches and large field forces of loan officers. But digital technologies are now allowing for new models of origination that, according to some fintechs, can reduce the customer origination cost by a factor of 10 while increasing the average quality of customers recruited, which also directly impacts customer retention and profitability. Digital channels are allowing for three types of customer origination:

- Direct origination via digital channels using software, applications, and platforms. Examples include Kabbage, BitBond, and Afluenta.

- Indirect origination via partnerships where lenders source digital data from partner organizations. Examples include Indifi, an Indian fintech with more than 80 partners, including merchant acquirers and e-commerce websites, and Tienda Pago in Peru, which partners with fast-moving consumer goods (FMCG) companies to acquire customers (merchants) and originate loans.

- Direct origination via in-field staff or digital marketing. Some providers use digital tools to augment traditional methods, which enables sales teams to meet customers in their areas of operation and collect know-your-customer or business data via tablets that upload information to centralized systems. This allows for quick or instant credit decision-making. One example is African lender 4G Capital.

Credit Assessment. Digital tools allow businesses to move away from paper and from lending based on the relationship between credit officers and borrowers. Some models, such as Kopo Kopo, use direct payment integrations to gain visibility into the MSE’s digital sales, which then creates the opportunity to layer further services, including automated repayments. Other models, such as Sokowatch, directly integrate into the back end to assess inventory turnover. Others, such as Branch and Tala, collect data on MSEs indirectly by accessing information captured by other organizations or by proxy indicators like social media and phone-scraping data. Emerging empirical evidence indicates that the predictive power of cash-flow data for credit scoring is just as high as traditional credit scoring techniques, which tend to be more exclusionary, and that the combination can be more powerful than either in isolation.

Disbursement. Digital tools improve the speed and ease with which credit can be disbursed. Disbursement models range from cash to noncash disbursements. Cash disbursement models involve solutions where cash is accessed at lender or partner cash-out points or cash is electronically credited to the bank account or digital wallet of the business. One model relies heavily on cash and requires cash management; the other model requires MSEs to have a bank account or digital wallet. Noncash disbursements usually range from provision of goods when the inventory goes low or a direct payment to the supplier, who in turn provides inventory to the business.

Monitoring and servicing. This includes providing MSEs with VAS like accounting, business-monitoring applications, business analytics, and more, which help small businesses learn how to improve and grow and provide the lender real-time information on the health of the business and repayment rates.

Collections. Financial institutions increasingly have the option to use digital tools that can improve the ease, speed, and timeliness of credit collection. The type of credit collections could range from scheduled payments, automatic deductions, or repayments via third parties. For example, some institutions (e.g., PayPal) offer automated deductions at the point of sale where repayment is a percentage of income and there are no fixed maturity dates set by the lender. Others use receivables-based financing where MSEs sell invoices to a lender at a discount and gain access to working capital. Lidya, a financial services platform, is one example of this.

Thus, in each major link of the MSE credit value chain, digital technologies are enabling new practices that can significantly reduce cost and expand access. The next section looks at four specific business models that have emerged as a result of these innovations. They are making significant inroads in closing the MSE financing gap and have demonstrated the potential to scale.

Emerging Digital Business Models for MSE Finance

These digital disruptions and the new capabilities they enable have led to new business models for MSE finance. Four models stand out because of their ability to solve the credit needs of MSEs and their feasibility to scale: digital merchant cash advance (unsecured credit), factoring (credit secured against inventory or inputs), and platform-based lending (unsecured and secured credit). (For more on these and other models, see “Bridging the Credit Gap for Micro and Small Enterprises.”)

Digital merchant cash advance: Unsecured credit. The growing use of digital sales and transaction tools by MSEs has laid the foundation for a simple yet powerful model in plugging the credit gap. Integration into digital sales and transaction tools provide records that can be used for credit assessment. They also allow for automatic deductions, reducing the risks associated with defaults while permitting businesses and lenders to dynamically set up repayment schedules based on the volume of sales as opposed to the traditional predefined monthly schedule based on manual methodology.

Fintechs using this model reported nonperforming loans ratios as low as 3 percent. Major market players that use this model include PayPal Working Capital, Kopo-Kopo Grow Loan, Amazon Lending, DPO’s Easy Advance loans, and Alibaba’s PayLater. Merchant cash advance loans were estimated at $272 billion in 2018, and this figure is expected to grow to $728 billion by 2025. The largest growth in lending volume is expected to come from China, where a quarter of businesses already use digital transaction tools.

Factoring: Credit secured against invoices. Factoring is a form of receivables or invoice-based lending that is traditionally available only to large businesses in highly formal contexts. By bringing down the cost, which provides greater efficiency and risk-of-credit assessment, and helped by the increasing ease of digital repayments, digital invoicing enables lenders to offer factoring to small businesses.

Lidya in Nigeria is an example of an online management platform that allows MSEs to upload their invoices. Based on the creditworthiness of the MSE’s corporate customer, Lidya offers cash—from as little as $150 up to $150,000—in exchange for the invoice at a discounted value.

The current market size for factoring-based credit in EMDEs is estimated to be around $1.5 billion. However, this lending model is expected to grow to $15.4 billion by 2025, driven primarily by the rapid increase in e-invoicing tools and the increasing introduction of regulations in many countries that require all businesses to digitally manage and record invoices for tax purposes.

Inventory and input financing: Credit secured against inventory or inputs. Digital tools for tracking and monitoring inventory purchases and turnover are allowing the development of business models that focus on offering MSEs inputs and inventory with the most appropriate credit terms. This reduces the risk for lenders and helps borrowers avoid the temptation to use a business loan for other purposes.

For example, Tienda Pago in Mexico and Peru provides merchants with short-term working capital to fund inventory purchases through a mobile platform. It partners with large FMCG distributors that place inventory with small businesses to acquire customers as well as data for credit scoring. The loan is disbursed not in cash but in inventory: the merchants place an order and Tienda Pago pays the distributors directly. The merchants then repay Tienda Pago digitally as they generate sales.

The potential size of this market opportunity is estimated at $460 billion and may increase to $599 billion by 2025. Apart from merchant education and acquisition, this model requires upfront investment in digital systems for ordering and tracking inventory use, a distribution system for delivering products, and geolocation of the MSE.

Platform-based lending: Unsecured and secured credit. Platform or marketplace models that enable the efficient matching of large numbers of lenders and borrowers may be one of the biggest disruptions in the MSE financing space. These platforms allow the holders of capital to lend to MSEs while avoiding the high cost of customer acquisition, assessment, and servicing. Importantly, they can also unlock new sources of capital, since lenders can be large numbers of regular people (as in the case of peer-to-peer lending), moderate numbers of individual investors, or smaller numbers of institutional investors.

Afluenta, a popular online platform in Latin America, lets MSEs upload their company details online, which it then cross-references against a broad range of data sources to generate a credit score. Afluenta then publishes the score and amount requested on the platform for prospective lenders to consider. Funds are disbursed and repaid digitally, which minimizes cost. No one lender is allowed to provide more than 5 percent of a given MSE loan, which helps to contain risk.

The estimated volume of lending on such marketplace platforms in 2018 was around $43 billion. Rapid growth in both developed and emerging markets indicate that it may grow to $207 billion by 2025.

Conclusion

These four models demonstrate how technology and business model innovation is making it viable and profitable to finance merchants and other MSEs in EMDEs, opening up a nearly $5 billion market. These lean digital models can make business possible where legacy bank approaches cannot. However, incumbent banks have cheap and ample capital, which fintechs sorely need to access to reach scale. Solving the $4.9 trillion MSE financing gap is likely to require unusual partnerships that combine the best of both worlds, deploying vast bank balance sheets through the digital disruptions that fintechs bring.

Like the ongoing explosion of digital consumer credit, these innovative MSE financing models don’t come without risks. Notably, the segment of MSEs that make up the target market for this type of financing may have a limited understanding of credit terms and may borrow more than they should. However, since many of these models are directly tied to the business (e.g., offering credit as inventory or linking it to sales already incurred), these risks are arguably less pronounced than for consumer finance.