|

Neither merchants nor their customers tend to see digital payments as inherently better than cash. In fact, when it comes to retail payments, cash has many strengths that digital solutions often struggle to match. Instead, the advantage of digital payments comes from the solutions and services that can be built on top of the payments element. For merchants and their customers, the true value of digital payments lies beyond the payment itself.

Therefore, when designing their merchant payments product and when pitching it to users, providers should focus on what value-added services (VAS) they offer on top of the payments product. These VAS should speak to specific pain points and use cases of prospective users.

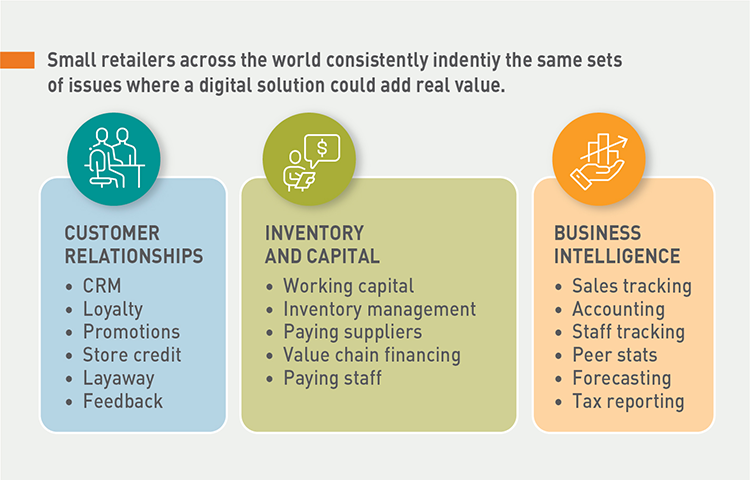

When it comes to merchants, small informal and semiformal business owners around the world tend to note very similar pain points around their operations. They tend to face challenges regarding customer relationship management, business intelligence, and operational aspects like inventory and access to finance.

The payments product can be leveraged to create a broader digital solution for merchants that includes VAS that address these pain points. If done well, these features are likely to be far more compelling to shop owners than the payments piece itself and, therefore, more likely to drive uptake and use. Providers should create value for merchants in areas where cash cannot compete.

Customer Relationship Management

Many small retail shops tend to be virtually identical in terms of their product selection and prices, so shopkeepers rely on their charisma and good memory to build and maintain a customer base. Today, most merchants do not have any real tools to support these. Some of the more driven among them keep paper logs that document what customer came when and phone numbers of top customers. But managing their outreach efforts to customers manually is prone to error and inconsistency and can be cumbersome, especially when owners must rely on staff, perhaps at several different storefronts, to implement it.

Digital payments create an automatic record of customers and their transactions, which can be used to fuel several simple but powerful tools to help merchants build and deepen customer relationships. When such tools are integrated into a suite of VAS connected to a digital payments product, they can add genuine value for the individual shopkeeper and be a significant driver of use.

A simple example of this is enabling merchants to send a mass SMS to the top 10 percent of their customers, perhaps to offer a holiday greeting or to advertise new inventory. Data from digital payments and customer records can help merchants to easily reach their top clientele by typing a single message (not 50 separate ones). They can reach out to customers, even if they don’t know exactly who the top customers are, let alone what their phone numbers are. There are many simple customer relationship management (CRM) solutions, including semi-automated messages to customers who spend a lot or who haven’t come by recently. These types of messages can be used for discounts, layaway functions, store credit management, and loyalty programs. For more on loyalty program models, see “Elements of a Successful Loyalty Model in Merchant Payments,” and for more on customer loyalty, see “Loyalty models can create value for consumers".

Operational Issues

Merchants face a range of practical issues in running their business, ranging from managing and ordering inventory to supervising and paying staff to accessing working capital to grow their business. Each of these areas represents an opportunity for payments providers to add genuine value for merchants.

The most common pain point that small and medium retailers identify is the lack of access to working capital and credit: 40 percent of formal micro, small, and medium-sized enterprises worldwide have unmet financing needs. Because of their scale and level of informality, banks are out of their reach. A few are served by microfinance institutions, but these institutions have not scaled nearly enough to keep up with demand, and they can be expensive because they rely on labor-intensive processes to assess creditworthiness. Therefore, most small business owners are financially excluded altogether or they rely on scarce and inconsistent sources of capital from friends and family.

Merchant payments may be the key to unlocking financial access for these businesses by generating detailed revenue data that support low-cost credit scoring and by enabling providers to deduct repayments at the source through repay-as-you-go systems, which further reduces risk to the lender. They are also an excellent source of nontransaction revenue. This combination makes digital credit potentially the killer app for merchant payments, as discussed in "Digital Credit Products Could Be the Killer App" and is also why such working capital products have long been used by major payments innovators like Square, PayPal, and Kopo Kopo.

This is far from the only operational VAS payments providers can offer, however. Merchants face a whole set of pain points around inventory, including keeping track of stock, ordering inventory, and paying for it. A payments solution could help merchants reduce cost and friction around this part of the business. Several companies already use these types of solutions. One example is Sokowatch and Jaza Duka in East Africa, which enable merchants to order tiny amounts of inventory on their phone, directly from the producers, with 24-hour delivery and substantially lower cost, thanks to the elimination of middlemen. Such players are also pivoting into providing small merchants with credit and other services on the basis of the data generated from this supplier-side transaction history.

Business Intelligence

Payments providers can also build simple, basic analytics tools for merchants to help them get a sense of how their business is doing and what they could do to improve their prospects. Tools that can provide small business owners insight into the market and their business are valuable, which is why the big card players like Mastercard have a large and growing focus on analytics services for small businesses.

In developing economies, the majority of merchants have only a fairly hazy idea of how their business is doing and what they can do to advance it, and much of this perception is based on gut instinct rather than any actual analysis. This is because even merchants who capture detailed paper records of sales typically lack the time and the skills to translate the information into hard analytics and actionable insight.

Building a digital solution that generates these types of analysis from payments data can be fairly straightforward. The analysis can be as simple as showing how sales this month compared to those of last month, or the same month last year. A tool that is a little more sophisticated could also compare performance to other merchants in the area, perhaps for businesses in the same category and size. Such analyses may involve trivial calculations, but to merchants, the information would be a revelation.

More advanced solutions can analyze transaction patterns in the market as a whole to provide merchants with recommendations on product and price opportunities based on seasonal patterns, particular events, or current sales at other merchants. Such intelligence could help a merchant stock up on particular items or adjust prices to match demand and competition in the market. Identifying these opportunities quickly and being prepared to take advantage of them would benefit small retailers who operate on very thin margins.

This type of analytics would integrate well with the type of inventory management features outlined above, thereby creating a seamless tool for merchants to ensure that they are stocking the right things in the right amounts at the right time. Such solutions would also constitute the first steps toward the profound transformation of retail commerce known as New Retail, which is discussed further in “The New Retail Revolution.”

Another area in which payments providers could easily support merchants is staff management, which tends to be a source of stress and frustration for shop owners. By having employees log into the system, a digital platform could monitor their relative performance and support simple incentives schemes or other management techniques that track and reward individuals who make greater effort.

Loyalty Programs

Aside from services that add value directly to merchants’ businesses, providers should consider creating loyalty programs for merchants. For example, a payments provider could create loyalty reward scheme for merchants to offer to their customers as part of an overall CRM toolkit. Reward schemes between the provider and its merchants can also have a powerful role in incentivizing merchants themselves by rewarding the ones that drive digital uptake with greater access to services, better terms, and so forth.

For more on reward schemes, see “Elements of a Successful Loyalty Model in Merchant Payments,” “Building a Successful Loyalty Model,” and “Loyalty Playbook.”