How Regulators Can Foster More Responsible Digital Credit

CGAP’s research in two fast-growing digital credit markets, Kenya and Tanzania, reveals that digital credit is not yet living up to its potential to advance financial inclusion. Widespread confusion about loan terms and conditions, coupled with high rates of delinquency and default, points to the need for stronger consumer protection measures. CGAP’s research, including a recent market monitoring experiment conducted with the Bank of Tanzania, points to some specific actions regulators can take by leveraging the growing amount of granular data on mobile money transactions. These actions are consistent with financial inclusion guidance from the Basel Committee, the G20/OECD Task Force on Financial Consumer Protection and the Global Partnership for Financial Inclusion.

Improve transparency on loan terms and conditions

Transaction data on more than 20 million digital loans made over 23 months in Tanzania showed that many borrowers were struggling to repay their loans. Borrowers defaulted on roughly 20 percent of the loans in the sample (4 million) and were late repaying 40 percent of the loans (8 million). We also saw that repeat borrowers were at risk of entering debt traps. One of the most important things regulators can do to reduce these numbers is to improve transparency on loan terms and conditions, making it easier for customers to make informed decisions.

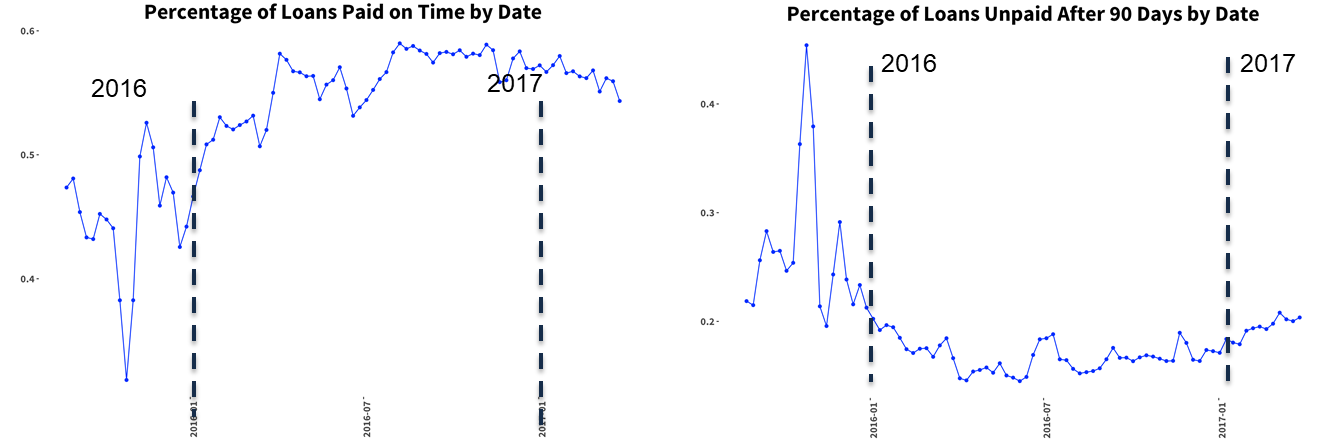

Tanzania: Digital Loans Paid on Time

A nationally representative phone survey conducted by CGAP in Tanzania indicates that poor transparency is correlated with high delinquency and default rates. Transaction data further suggest that borrowers would benefit from more transparency. It shows that most first-time borrowers paid either too early or late and that they ended up paying much higher APRs than borrowers who paid on the official due date. New borrowers often began by taking a string of short-term loans and shifted to longer-term loans with lower APRs over time. This suggests that customers had to learn the hard way that longer-term loans are cheaper.

Tanzania: Loan Term Choice by Number of Loans Taken

Regulators should require digital lenders to provide all customers with information on key terms and conditions, including the total cost of credit (incorporating service charges and fees applicable to all loans) and the consequences of early or late repayment, including fee amounts. This information should be presented in a way that is clear and easy to understand, through all relevant distribution channels. Based on experiments with several digital lenders, CGAP has recommended a few practical solutions to improve transparency, such as providing price and other key information before a consumer accepts a loan or making consumers actively opt out of viewing a summary of terms and conditions.

Adopt stronger credit risk assessment policies

Better credit screening models and financial product governance could also reduce delinquencies and defaults. First-time borrowers who take small loans under Tsh 10,000 (about $5) are, by far, the most likely group to repay late or default. In markets like Tanzania, where digital credit has been offered for a few years and lenders have gathered a great deal of data, credit screening models can be adjusted to better predict the repayment capacity of first-time borrowers. Regulators should assess the appropriateness of existing models and require revisions based on an analysis of the growing amount of granular data available on digital credit and its effects on borrowers. Monitoring exercises like CGAP’s transaction data analysis with the Bank of Tanzania may be useful.

Tanzania: Repayment Rates by Number and Size of Loans Taken

Regulators can also make digital credit work better for consumers by requiring lenders to carry out adequate customer and product assessments so that they offer products that suit customer needs. Transaction data from Tanzania show that a large number of borrowers habitually repay late and accumulate heavy penalty fees without receiving material increases in their loan amounts. About 3 percent of borrowers took five loans and repaid each of them late with average APRs of more than 700 percent. It appears that the conditions (e.g., term, value, repayment schedule) of delinquent borrowers’ subsequent loans were not adjusted in a way that encouraged them to repay and minimized their risk of falling into debt traps, which can harm borrowers and make them more likely to default. Overall, these repeat borrowers would have been better served by first-time loans with longer terms. One way to ensure product suitability is for regulators to require lenders to have adequate financial product governance processes and procedures for designing, approving, distributing, reviewing and modifying retail financial products. Good governance and fairness in digital credit would help providers offer first and subsequent loans that consider borrowers’ needs and constraints and lead to positive consumer outcomes. For example, lenders could also reward borrowers who repay early with discounts on subsequent loans.

Strengthen information sharing without harming borrowers

The default rate for first loans under Tsh 10,000 is nearly 40 percent, whereas the rate for larger loans is less than 25 percent. As this disparity seems to be associated with weak credit screening models, there may be a disproportionate downside to reporting to the credit bureau millions of poor borrowers who are struggling to repay their first-ever loan. By requiring lenders to report these borrowers, regulators risk re-excluding poor people who have long been excluded from the formal financial system, just as they are starting to build a credit history.

Regulators can address this problem by setting up a minimum threshold for mandatory credit bureau reporting of all digital loans that excludes the smallest-value, first-time loans. This approach would facilitate compliance with credit reporting requirements without excluding good borrowers, who often take subsequent, larger loans that would be reported to the credit bureau. It is true that a threshold gives first-time borrowers less incentive to repay, raising legitimate moral hazard concerns. However, digital lenders that choose to mitigate risk by offering loans at high cost, rather than by conducting rigorous credit assessments of first-time borrowers, must accept some responsibility for their business model — particularly if they are advertising loans via unsolicited SMS or web ads.

Since digital credit is becoming a large portion of the credit information systems in developing countries with mature digital finance markets, it is also important for regulators to require digital lenders to report full-file records for all loans above the threshold. Digital lenders typically do not report any type of credit information or report only delinquent loans (i.e., negative information). Thus, providers and regulators do not have complete information on the total credit obtained by individual borrowers and their capacity to repay their debts. This makes it hard to see whether a consumer credit bubble may be forming at a market level. Reporting the full file will help new borrowers build their credit payment history and make it available to other lenders. Using the type of transaction-level analysis CGAP conducted in Tanzania, regulators could develop rules for expanded credit reporting that balance the benefits of positive information with the consequences of small-balance defaults.

CGAP’s analysis of Tanzanian transaction data shows that granular data on repayment rates and loan costs can help regulators uncover troubling or unfair digital credit business models that may be relying on nontransparent fees and less on interest payments. This has been a sign of unhealthy sector development in traditional credit markets, so it is important to discover early on and closely monitor the situation, including consequences for borrowers, at the entity and sector levels through better credit reporting systems. As digital credit markets mature and more data become available, regulators will need to require providers to adjust their models and develop more effective repayment incentives that do not depend on excessive fees.

Add new comment