Understanding Typical Financial Behavior in Myanmar

Putting customers at the center and better understanding demand for financial services among different segments of an unbanked population is a key priority for the development community.

The recent Making Access to Financial Services Possible (MAP), undertaken by UNDP/ UNCDF, CENFRI and Finmark Trust with funding from LIFT, provides a gold mine of information on the demand for and supply of financial services in Myanmar. It is based on interviews with 5,100 households, and the results were presented on 22 and 23 May at a conference in Naypiytaw.

Some of the figures from the survey tell us a lot about what a typical household in Myanmar looks like. For example:

- 70 percent of households are rural with close to five people in the house.

- The level of education is generally very low, with only one-third of people going beyond primary school.

Houses are typically made of timber and bamboo with a tin roof and electricity is only available for a few hours a day, if at all. - It takes people one hour and 30 minutes to get to the closest bank branch.

- Forty-two percent of adults claim they have access to a mobile phone, although this varies from one region to the other. In terms of economic activities, over half of adults are involved in farming, primarily rice.

- The poverty rate is very high and about half of income earners make less than $2 a day. People’s largest expenses are on education (34 percent), followed by health and electricity.

Typical financial habits

Culturally, borrowing is not viewed very positively and 88 percent of people interviewed think that it is bad for future lives if one dies owing money. Only five percent of people have access to a bank account and less than five percent have a savings account, lower than what we at CGAP and IFC originally expected. More than half of the respondents to the survey said that they would need formal employment to be able to open an account, and 63 percent of respondents say they do not have enough money to save anyway. Thirty percent of people have access to at least one form of financial service (credit, savings, insurance and remittances), but if we remove remittances from the equation, the number financially included drops to just 20%. Most of the financial access comes through the Myanmar Agriculture Development Bank, a state-owned institution, regulated pawn shops, and PACT, the leading microfinance institution which UNDP has supported since it started. Given the lack of formal supply, many people turn to informal financial sources.

The survey highlighted the very significant role of the informal sector. Family, friends, and money lenders are the primary sources of debt in Myanmar. In fact, there are five times more people who borrow from informal sources than from a formal provider. Nearly 6 million adults borrow from unregulated money lenders each year, and there is a total outstanding debt of $3.9 billion.

Seventy percent of adults think it’s important to save, even when income is low. Most people save at home, in the form of livestock or gold. There seems to be pockets of over-indebtedness with two percent of respondents claiming they cannot pay back their debts, possibly due to very high interest rates from money lenders.

Usage of other formal financial services in Myanmar is also very low. Only 11 percent of adults had received domestic remittances and nine percent had received money from abroad, mainly from Thailand. The usage of insurance is almost non-existent with only 30 percent of people even knowing about insurance. An interesting feature of the survey given the upcoming launch of Ooredoo and Telenor is the fact that one-third of interviewees are interested in using phones to transfer money and make payments.

Segmenting the market

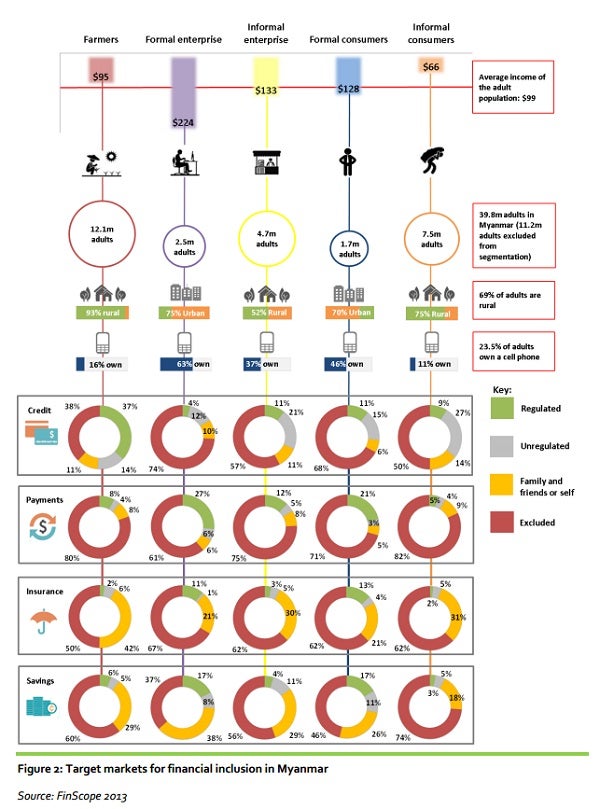

The MAP Study segmented the market into five target groups for financial inclusion in Myanmar: Farmers, Formal Enterprises, Informal Enterprises, Formal Consumer market, Informal Consumer Market. The diagram below summarizes credit, payment, insurance and savings for each target market.

Next steps

So what comes next? First, different stakeholders (providers, policy makers, donor and investors) are starting to use all the data and findings to guide their policies. This is part of the objective of MAP. The data raises several key questions such as: how can policy makers support the expansion of savings with such low usage of formal savings services? How can the sector become more sustainable since it is now highly subsidized? How can telcos and other players fill the huge gap in terms of payments? This data will serve as an input for providers that seek to take a “client-centric” approach and get deeper analysis of the different segments and trends that the MAP has identified.

These types of questions will hopefully help Myanmar prioritize which areas should be given the greatest focus. Understanding financial behavior and gaps in available services is the first step to building a more financially-inclusive Myanmar.

Comments

I am always surprised when

I am always surprised when reading analysis such as these that the first response is figuring out how to link the rural poor to formal financial services. For a tiny fraction of the cost, staff and complexity every two or three villages could be trained to form savings groups building on the customs of savings in ROSCAS already in place. Within four years (if the outcomes in Uganda are similar) two new groups will be trained by members of the first group. The outcomes (if RCT data from Mali are similar in Myanmar) decreased chronic hunger, more assets - more livestock mainly - and reaching the poorest ($0.50 or less daily income). This is for entire village not just those who join groups. New groups sprung up spontaneously in control villages at no cost to the program. The cost about $1 per villager in a village of 1,000 inhabitants with about 80 of these part of savings groups. As these groups mature they will reach out to financial institutions for loans larger than the groups can provide. In this way the financial sector could evolve organically from informal to semi-formal (savings groups) to formal. Myanmar has a population of about 55 million so an investment of $20 million spread over a decade would be sufficient to launch savings groups in a critical number of villages nation-wide with viral replication filling in the spaces between villages as outreach expands. The Saving for Change program I led in Mali grew to 20,000 groups with 450,000 women members in at least 5,000 villages with a total staff that never exceeded 203. With current staff of 40 or so there are no signs of the groups faltering. See my new book: In Their Own Hands: How Savings Groups are Revolutionizing Development." Look on the Berrett Koehler website and download the fall catalogue for a free peek. Jeff Ashe

Perhaps the key priority is

Perhaps the key priority is to raise rural income ie better prices for farm crops, higher farm productivity, loans for farm equipment. One has to have income in order to even open an account. Agents can be appointed to open basic accounts for rural folks, and mobile phones can be used to pay for services or goods even in the rural setting. Its a very nice and informative article. Helps me in my current work and understanding.

Add new comment