What APIs Are Digital Financial Services Providers Opening?

When digital financial services (DFS) providers open APIs, other businesses can start innovating on top of the providers’ platforms, adding a diverse range of customer use cases that benefit providers, developers and customers. This is starting to happen. In Nigeria, for example, a FinTech called Piggybank helps users create savings plans by periodically deducting money from their bank accounts and locking the savings until an agreed date. The app uses APIs from digital payments providers Flutterwave and Paystack to facilitate the deductions. To date, the app is credited with helping Nigerian residents to collectively save 1 billion Nigerian naira (almost $3 million), all the while generating revenue for the API providers and third-party developers.

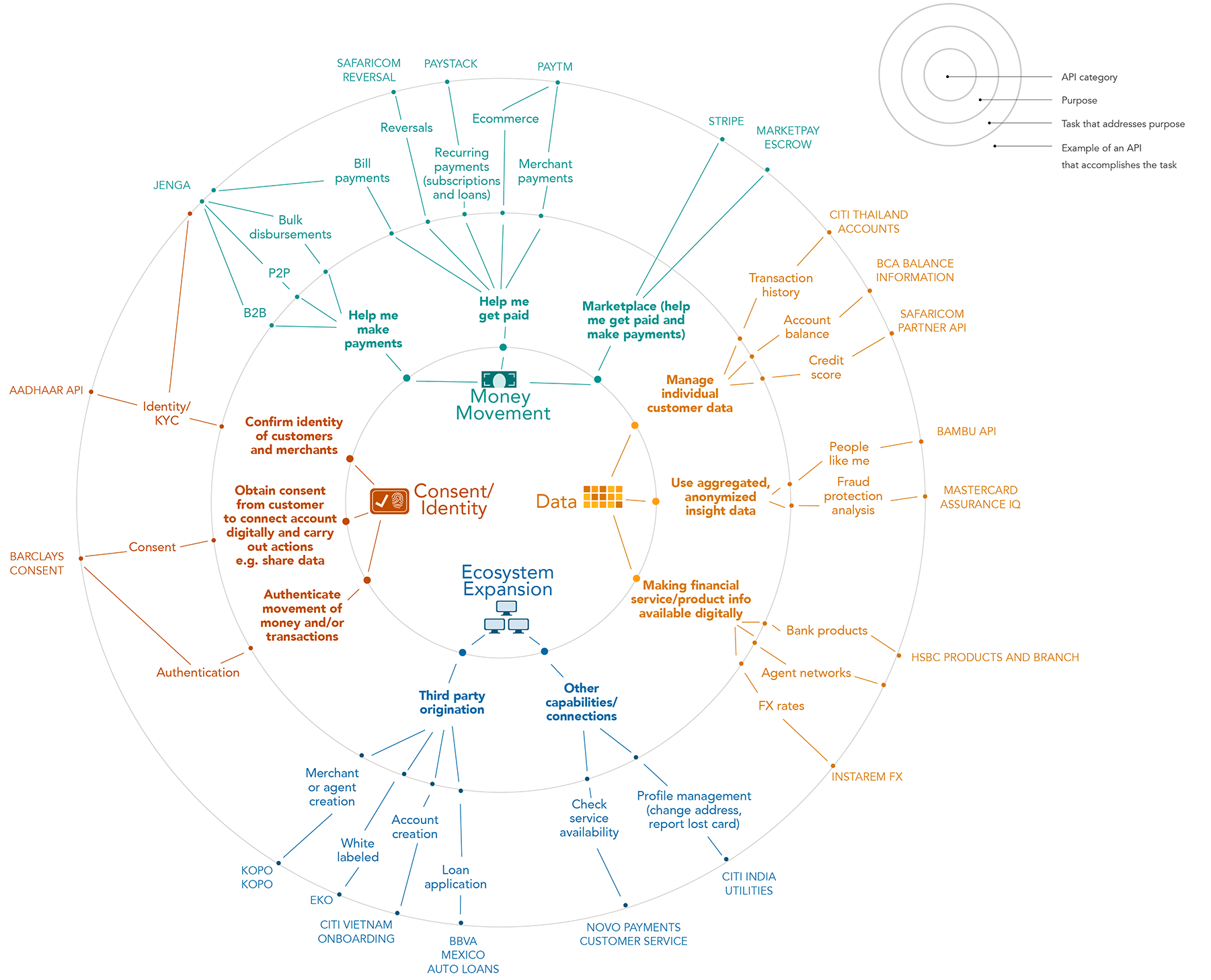

There are compelling reasons for a DFS provider to open APIs, but there are many types of APIs. The types of APIs that providers choose to make available influences which solutions third parties can build and, in turn, the impact these solutions have on providers’ bottom lines and on financial inclusion.

What types of APIs are DFS providers opening?

Since early 2018, CGAP has been tracking open APIs in the DFS space on our API dashboard. Generally speaking, we see DFS providers deciding to open APIs that enable third-party developers to do four things: move money, leverage providers’ customer data, manage customers’ identities and consent and reach new customers through services like account opening, loan applications and customer service capabilities.

How are DFS providers getting started?

There is no defined sequence to follow when opening APIs. However, DFS providers tend to start with their core payments business, offering money movement APIs that enable businesses (brick-and-mortar merchants, billers, e-commerce players, etc.) to receive payments from customers and pay employees or suppliers (primarily bulk disbursements and business-to-business payments). There are several reasons providers decide to start with these APIs.

First, money movement APIs often align with DFS providers’ strategic business goals. Bulk disbursement APIs increase the amount of cash in customers’ mobile money wallets, and merchant payment and e-commerce APIs broaden where and how customers can use their wallets.

Second, there is demand from third parties for these foundational APIs, especially among businesses that are just starting to integrate external APIs into their processes. Money movement APIs offer third parties a cheaper, faster, more transparent way to integrate with a payments solution.

Third, from a provider perspective, these are low-risk APIs that can be opened with limited effort. Moreover, they are reusable across a range of common end-customer use cases beyond payments, including savings, credit, education and e-commerce.

Lastly, payments APIs are becoming important from a competitive standpoint. As a growing number of mobile money wallet providers, banks and global payments providers offer merchants payment capabilities via APIs, any DFS provider that wants to build market share will soon need to have a payment API product.

Beyond these foundational payment APIs, there are several payment-related APIs that might form part of the initial API package. Instant payment notification APIs help third parties keep track of when customers are making payments. Request to pay APIs, transaction status APIs and payment reversal APIs are also useful to third parties and are becoming more common.

What other APIs are being offered?

Which APIs to release next depends on the market and provider, but a few emerging approaches are worth noting.

- Monetizing customer data. Providers that have the necessary customer consent functionality in place can choose to monetize individual customers’ data by offering an API for credit scores or similar risk metrics. DFS providers that offer a digital credit product are often well placed to deliver this type of API, as they have already thought through what they can offer and how the technology and economics work. Safaricom is a good example. It launched a credit scoring API after previously enabling products like KCB M-Pesa to use its credit scoring model within its loan application process. Ant Financial (through Sesame Credit), Tencent and Paytm are also at various stages of exposing similar credit scoring capabilities. Of course, there are important customer protection and data privacy issues that need to be carefully managed when it comes to data APIs.

- Monetizing other assets. DFS providers in Asia are starting to open access to their agent networks and other assets beyond customer data. Offering access to agent networks could potentially improve the value proposition and economics of remote agents, add a revenue stream for DFS providers and make it easier for remote customers to access financial and other services, such as e-commerce. White labeling core capabilities could also be opened, as Eko is doing in India.

- Advanced payments. Providers can offer advanced payment APIs that do more than facilitate payments. One example is Paystack’s split payment API, which allows an e-commerce platform owner and a seller on the platform to split a payment so that the platform owner automatically receives her commission and the seller receives his payment, net of platform fees. Stripe’s marketplace API goes further, facilitating the onboarding and verification of sellers.

- Co-creating the DFS ecosystem. Some DFS providers offer APIs that third parties can use to help drive their business. Examples include account or wallet opening APIs like Citi Bank’s in Vietnam and loan origination APIs such as BBVA’s.

Beyond these opportunities, DFS providers should pay attention to what is happening elsewhere. Consider, for example, Equity Bank subsidiary Finserve’s Jenga API. It aims to help developers and other creators build better solutions by offering send money, bill payment, purchase, credit, account management, know-your-customer/anti-money laundering and cross-border remittance APIs. In August 2018, Finserve said it was reaching “4 million people daily through its APIs, working with 136 developers and SMEs.”

As DFS providers create basic open API infrastructure and deliver value through foundational APIs, we expect to see them start experimenting with less proven APIs. APIs that push the frontier have the potential to enable more innovative solutions and position forward-thinking DFS providers at the center of emerging digital ecosystems.

To stay up to date with CGAP’s work on open APIs, sign up for our semi-regular "Digital Rails" newsletter.

Add new comment