Case Study on JICA

|

Within Japan’s International Cooperation Agency (JICA), the Office for Gender Equality and Poverty Reduction (the Unit) has the mandate to advance financial inclusion through policy guidance and technical assistance to JICA’s operational departments responsible for development sectors such as rural development and health. In recent years, the Unit has come to realize that there is a gap between understanding the importance of financial inclusion in principle and knowing how to actually integrate it in one’s sector. With this in mind, the Unit has sought a new approach: rather than operate “from the outside,” why not embed financial inclusion within JICA through hybrid demonstration projects that show how financial inclusion contributes to development objectives and how integrated solutions actually happen? |

Background

For many years, the Unit carried out several activities intended to mainstream financial inclusion across development sectors in JICA. It regularly gave project advice to other sectors at the planning phase as part of the internal appraisal process. It also organized training and seminars for JICA staff and consultants on key principles of financial inclusion and the market systems approach. In addition, the Unit periodically conducted research on the impact of JICA projects with financial inclusion components to generate and disseminate insights across the organization.

Despite these activities, actual integration of financial inclusion perspectives into other sector projects rarely happened. In the instances when sectoral departments chose to incorporate a financial inclusion component in their projects, these components often focused on providing patchy solutions. For example, after the Unit disseminated the research findings on village revolving funds (see Box 1), some projects tried incorporating financial literacy training. Others tried to encourage financial services providers (FSPs) to offer services to farmers, but this did not last beyond the project period, when the subsidies ended. The projects achieved less than optimal results because these financial inclusion components were introduced without a proper market diagnostic.

With only three staff in charge of financial inclusion within the Unit and a small dedicated budget, the team pushed itself to creatively address the challenge of mainstreaming financial inclusion within JICA. This was especially important for the Unit because financial inclusion had been repositioned as an enabler of many of the Sustainable Development Goals rather than as an end in itself.

In this context, the Unit has sought to do something new: to design and implement a few demonstration projects that combine financial inclusion objectives with other sectoral objectives. These projects are expected to produce use cases of how integrated approaches happen. In addition to serving as evidence of what works and what doesn’t, the use cases will provide guidance to JICA staff.

|

BOX 1. Research on impact and sustainability of village revolving funds JICA implements a large number of projects focused on forest management, agricultural productivity enhancement, and livelihood enhancement for rural communities. Many of these projects involve village revolving funds to create saving and credit services in the community. While the Unit already knew that global experience with village revolving funds was less than stellar, it needed to convince JICA project managers of this with concrete evidence from JICA’s own portfolio. From 2013 to 2015, the Unit reviewed 15 projects in Asia and Africa to evaluate the impact of the village revolving fund approach in creating an effective and sustainable pathway to livelihood improvement. The research showed that many of these funds failed because of a lack of fund management capacity and low loan repayment rates. Some projects had already depleted nearly half of the fund amount at the end of the project due to mismanagement. Some others did well, but only during the project period when JICA provided hands-on support in fund management. Most of the funds were making a loss within three years after the end of the project period. As part of its recommendations, the Unit suggested that projects should build relationships with FSPs in the local market. |

The approach: From demonstration to integration

To mainstream financial inclusion internally, the Unit needs to be perceived as an “inside” collaborator that works with the relevant sectoral

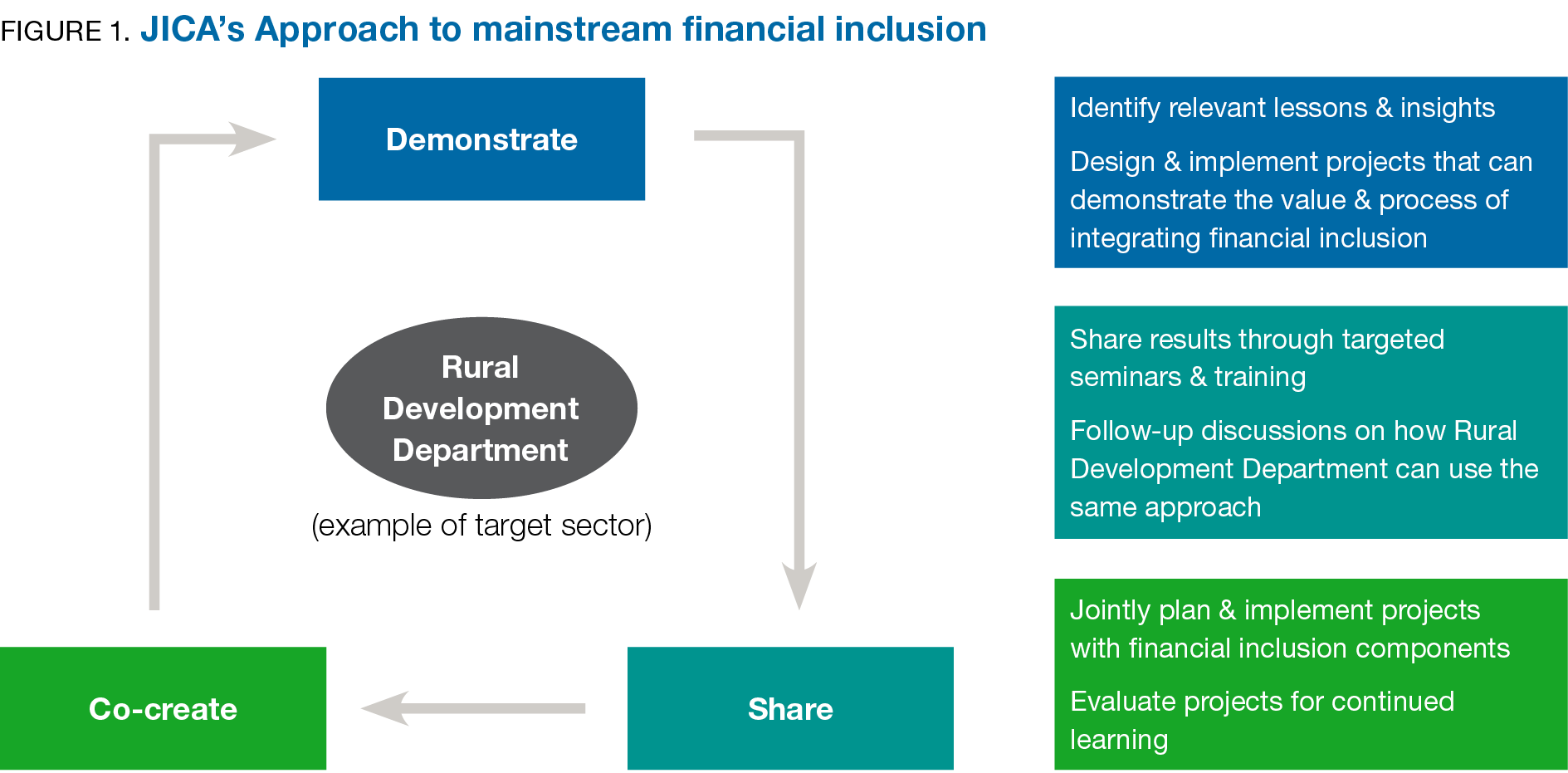

departments on joint projects—and not as an “outside” adviser who dispenses guidance on projects without being involved. To achieve this, the Unit developed a three-step approach to become an inside collaborator: demonstrate, share, and co-create. (See Figure 1.)

1. DEMONSTRATE

In this first phase, the Unit designs and implements projects to make the case that financial inclusion matters for other sectors, using JICA’s own experience. The Unit strategically selects projects that can generate lessons and insights for other sectors. It is focusing on the rural development and health sectors because JICA implements many technical assistance projects in these two sectors. For example, the Smallholder Financial Inclusion Project in Albania works with partner FSPs to help them become more customer centric so that they can respond more effectively to the needs of smallholder farmers. The project seeks to generate insights on the use of financial services for nonproduction purposes, such as housing, education, and health, and on how synergies between financial services and nonfinancial services for agricultural production can benefit smallholder farmers. More broadly, the project aims to show how JICA’s Rural Development Department can work with its in-country partners—FSPs, government entities, and others—to improve their products, services, and processes based on the expressed needs and aspirations of farmers and other rural communities.

2. SHARE

As the demonstration project progresses, the Unit convenes the relevant sections of sectoral departments to share findings, the impact of the financial inclusion component on the targeted communities, and the process of planning and implementing the project, using convincing and easy-to-understand evidence. The goal is to share results at the initial, midterm, and conclusion phases of the projects. For example, last year, the Unit organized a seminar targeting the Rural Development Department. The Unit used the Albania project to illustrate how JICA departments can work with each other to improve and develop products and services that align with the real needs of farmers. The seminar led to a series of meetings where the Unit and the Rural Development Department discussed how the agricultural sector can incorporate a financial inclusion approach in its operations.

3. CO-CREATE

Once the Unit has the buy-in of the targeted department, it proposes the integration of financial inclusion components into the department’s projects. The focus is on identifying projects that are already in the pipeline for which a financial inclusion perspective could be most beneficial—no new projects are created. In the co-creation phase, the Unit makes an initial proposal on how the sector in question can integrate a financial inclusion perspective into its projects and discusses options for the financial inclusion component based on the projects’ scope and budget. As part of the co-creation, the Unit joins the fact-finding missions that most projects conduct at the design stage and helps to develop a feasible project design. For example, the Unit’s discussions with the Rural Development Department led to collaboration on a co-created project—the Food Value Chain Improvement Project for smallholder horticultural farmers in Myanmar. In a recent joint fact-finding mission, the Unit identified the demand for financial services and potential partnership with microfinance institutions, fintech startups, and mobile network operators. As a result of the joint planning, the project included a partnership component for FSPs and allocated budget for a financial inclusion expert.

Results

This work-from-the-inside advocacy approach was key in helping to build other sectors’ understanding of and confidence in financial inclusion considerations. The Unit is currently implementing a co-creation project with the agriculture sector and is planning another project with the health sector. The co-created projects are still in their early days, and project results are yet to be produced. Nevertheless, there is evidence of strong interest within JICA. The Unit has started to receive requests from other sections of JICA’s agriculture program, as well as new consultation requests from other sectors such as education and micro and small enterprise development.

Lessons learned

Co-create early in the project lifecycle so that financial inclusion can be a significant part of the project scope and budget. When the Unit tries to co-create financial inclusion components within existing sectoral projects, the degree of incorporation is often limited due to misalignment with the original project scope and the financial and human resources already allocated. This can limit the scope of financial inclusion interventions because they have to fit within an overall existing project structure. In addition, existing sectoral projects have their own priorities.

Promote internal guidelines for project design to help amplify mainstreaming efforts. Given the Unit’s limited resources, it cannot realistically be expected to demonstrate, share, and co-create across all of JICA’s development sectors. To enable mainstreaming efforts at scale within JICA, the Unit plans to use the experience from co-creation projects to develop guidelines on how to integrate financial inclusion in the project planning process. Targeted sectors as well as other sectors can use these guidelines to design financial inclusion components based on emerging practices.

Build relationships and trust between the Unit and the other sectors. As co-creator, the Unit becomes part of the project team of other sectors by joining team missions and participating in related discussions. This approach not only helped the Unit to better understand the perspectives and constraints of the other sectors so that it can deliver more effective and realistic advice, but it also helped to build relationships and trust between the two teams. As a result of the co-creation projects, several financial inclusion “champions” have emerged from among the staff in the agriculture and health departments. These internal champions—leaders in the co-creation process—have emerged as some of the most effective advocates for financial inclusion in JICA by disseminating positive messages about financial inclusion integration among their colleagues, which in turn could generate more opportunities for future co-creation.

|

This case study is part of a series on how CGAP members are attempting to break down silos and create financial inclusion linkages with and across other development sectors. View complementary case studies that highlight UNCDF's efforts to build cross-sector partnerships to amplify impact, USAID's efforts to engage with country offices to embed digital finance, and AFD Group's creation of a thriving internal community of practice. |